You’ve been running your small business as a sole proprietorship, but you’re starting to wonder if it’s time to switch to a limited liability company, or LLC. There are many benefits to making the change, especially for a growing business. An LLC offers liability protection and tax flexibility that a sole proprietorship just can’t provide. Thankfully, transitioning from a sole proprietorship to an LLC is totally doable and can even be hassle-free.

In this article, we’ll walk you through the essential process of converting your sole proprietorship into an LLC, including steps like filing the correct paperwork, notifying clients and vendors, handling your accounting and tax obligations, and updating your business operations. If you’re ready to take your small business to the next level, read on to learn how to successfully change from a sole proprietorship to an LLC.

The key differences between a sole proprietorship and an LLC

Before you make the switch from a sole proprietorship to an LLC, it’s important to understand the key differences between the two business structures.

| LLC | Sole proprietor |

| Limited liability protection | No liability protection |

| Choose which kind of business taxes to use | No choice regarding business taxes |

| The business is a separate legal entity | No legal separation between you and your business |

| Can be complex to set up | Easy and low-cost to set up |

Liability

The biggest advantage of an LLC is that it provides limited liability protection. This means the members of an LLC, namely you, the business owner, are not usually held personally responsible for business debts and liabilities. Sole proprietors, on the other hand, hold unlimited personal liability for their business, so if your business can’t pay its debts, creditors can claim your personal assets.

Tax flexibility

LLC owners can usually choose which kind of business taxes to use for their business income. That means that it’s up to you if you want to be taxed as a sole proprietorship, partnership, or corporation. But sole proprietors have no such flexibility, and always have to pay taxes on business income as individuals.

Business entity

An LLC is considered a separate legal entity from its owners, which is why you don’t usually bear personal liability for business debts. It also means that LLCs can own property, enter into contracts, and sue or be sued as a company, so your business decisions and disputes aren’t personal. But in a sole proprietorship, the business owner is the business and there’s no legal distinction, so all the business you conduct is in your personal name.

Cost and complexity

On the downside, it can be complicated to set up and run an LLC. It typically costs a few hundred dollars to set one up, and you’ll have to file official documents with your state. Sole proprietorships are much easier and lower-cost to set up. LLCs also tend to require more complex record-keeping and paperwork to remain in good standing.

For small or new businesses, a sole proprietorship may suit you best, and you might not see the need to pay extra to establish an LLC. But as your business grows, the extra investment of time and money could be worth it to benefit from limited liability, tax flexibility, and legal separation between you and your business entity.

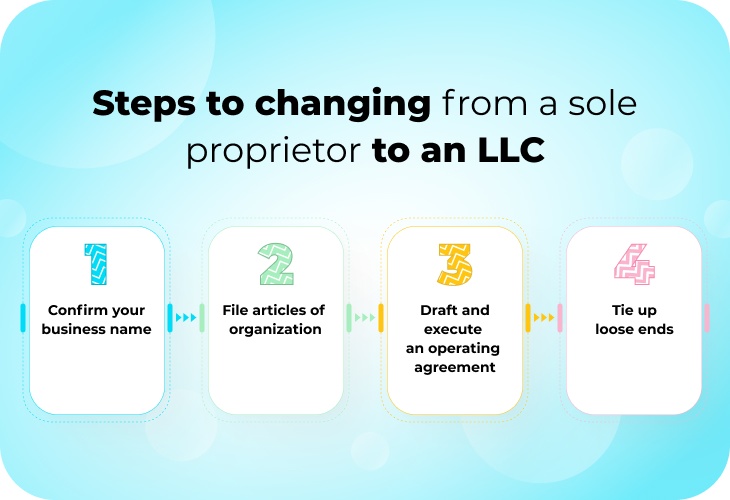

How to change from a sole proprietorship to an LLC: a step-by-step guide

Once you’ve decided an LLC is the right move for your business, it’s time to make the change official. Here are the essential steps to transition from a sole proprietorship to an LLC:

Step 1: Confirm your business name

Double check that the name you want to use for your LLC is not already trademarked. Search your state’s business database as well as USPTO.gov to be sure that your business name is available. If the name is taken, you’ll need to choose a different one.

Step 2: File articles of organization

The articles of organization, also known as a certificate of formation, are what formally establish your LLC. You’ll need to file this document with your state, typically at the Secretary of State’s office, and pay a filing fee that’s usually a few hundred dollars. The articles of organization include information like your LLC’s name, address, registered agent, and ownership structure.

Step 3: Draft and execute an operating agreement

An operating agreement outlines how your LLC will be organized and run. It’s not required in all states, but it is highly advisable. It’s best to work with a lawyer to draft an agreement that covers issues like ownership percentages, management roles, voting rights, dissolution procedures, and more. All LLC members should review and sign the final agreement.

Step 4: Tie up your loose ends

Now that you’ve set up your LLC, you need to make sure that every business account, permit, or license relates to your new business structure. That includes:

- Closing any sole proprietorship business licenses or permits, and opening new ones for your LLC

- Updating your business accounts, insurance policies, contracts, marketing materials, and anything else under your former business structure.

- Notifying your employees about the change and updating their employment agreements and payroll details.

- Checking with your city or county clerk’s office to see if your new LLC needs any new local business licenses or permits.

Do you need to change your EIN when switching from sole proprietor to LLC?

If you already have an Employer Identification Number (EIN) for your sole proprietorship, the IRS recommends that you get a new one when you form an LLC.

An EIN is like a business’s social security number—it identifies your business for tax purposes. Your sole proprietorship’s EIN is connected to you personally, as the business owner. When you form an LLC, you are creating a separate legal entity which needs its own EIN. Don’t worry, obtaining a new EIN is free, and can be done quickly on the IRS website.

Some reasons you may want a new EIN for your LLC:

- A new EIN ensures your LLC’s assets, liabilities, and tax obligations are separate from your previous sole proprietorship.

- Many cities and states require an EIN to obtain certain business licenses and permits.

- Banks typically require an EIN to open a business bank account in your LLC’s name.

- Your LLC will need to file its own tax returns, like Form 1065, and that requires a separate EIN.

Be sure to apply for your LLC’s EIN as soon as you have filed your articles of organization. Once you have your new EIN, you can open a business bank account, obtain necessary licenses, and handle other tasks to get your LLC up and running.

The sole proprietorship to LLC guide

So there you have it, the key steps to transition your business from a sole proprietorship to an LLC. It may seem daunting, but changing from a sole proprietorship to an LLC sets your business up for success, and gives you stronger legal protections and tax benefits. Once the paperwork is filed, you’ll have the peace of mind knowing your personal assets are shielded and you can get back to doing what you do best – running and growing your business.