Knowing how to price your services as a small business owner is an art in and of itself. If you want to succeed, you need to do more than simply check how much your top competitors charge and put the same price tag on your offer.

There are plenty of factors you need to consider – from your overhead costs and target customers to any differentiating factors like your experience. In this post, we’re going to help you understand how to price a service properly. We’ll also show you how to get a good profit margin while keeping customers happy.

How to price your services

Here are two questions many small company owners ask themselves:

What is the most effective pricing strategy?

Each company is unique, so there isn’t a single approach that guarantees success. That said, some common pricing strategies include:

- Dynamic pricing

- Price skimming

- Competitive pricing

- Price bundling

- Market penetration pricing

- Psychological pricing

Ultimately, the most effective pricing strategy is one that lets you grow and scale your business, attracts the right customers, and makes you and your employees feel rewarded.

These factors are both subjective and objective in nature. You can put a number on your profit margin and decide that you want to earn, say, 10% on each service. Meanwhile, the path toward converting a lead calls for a mix of psychological tricks like persuasion and creating a sense of urgency (like a limited-time discount).

Which pricing method is the best?

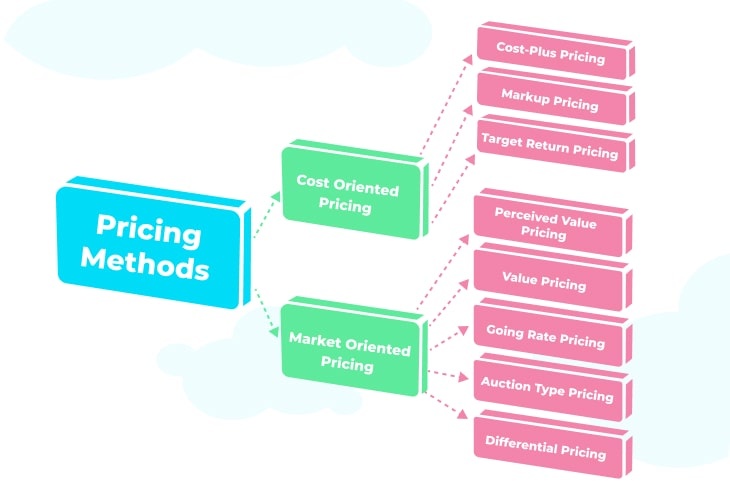

Most pricing methods fall under one of two types – cost- and market-oriented. The first category circles around all the expenses you incur and how much pure income you want to make. These can be broken down into three main subcategories:

- Cost-plus pricing

- Markup pricing

- Target return pricing.

The second pricing method category prioritizes a mix of market and industry circumstances. These pricing methods include offering different prices to different customer segments based on value perception. For example, one group will want to pay a higher price just because it reassures them of the service quality.

Market-oriented pricing includes the following:

- Differential pricing

- Going rate pricing

- Auction-type pricing

- Perceived-value pricing

- Value based pricing

Naturally, you don’t have to put all your eggs in one basket – many successful businesses inspire themselves with a variety of these approaches and create a custom formula.

How about the rate? Should you price your services by the hour, offer a flat fee, or, maybe, tiered pricing (i.e., a pricing strategy where extra services cost money)?

Should I charge by the hour or by the job?

Hourly-based pricing has its benefits and drawbacks. Whether it will work for you depends on the type of services you offer and, potentially, how familiar you are with the customer.

Sometimes, it’s more reasonable to charge a flat rate because that’s what others in your field do. Let’s take hair salons as an example.

You don’t normally see a hair stylist charge per hour, do you? That’s because customers want to know how much it will cost before they schedule an appointment. Still, this doesn’t mean that the salon owner doesn’t have a per-hour price estimate in the back of their mind.

Still, if it’s common for professionals in your line of work to use both flat and hourly rates, consider the following advantages:

Charging by the hour

- No unpleasant surprises, such as a project requiring twice as many hours to complete than what your flat rate covered

- Creates a sense of mutual respect (if you can’t estimate how long a job will take, then a price per hour will be fair for both sides).

Flat rate

- You know how much you’re going to earn in advance.

- Transparent pricing. Your client doesn’t have to worry they’ll be charged more than they expected. Plus, as the cost is clear, you can ask them for an upfront payment through an online payment processing tool.

- You might earn more over time. The better you know your customer, the faster you might get at completing projects.

How do you price a service per hour?

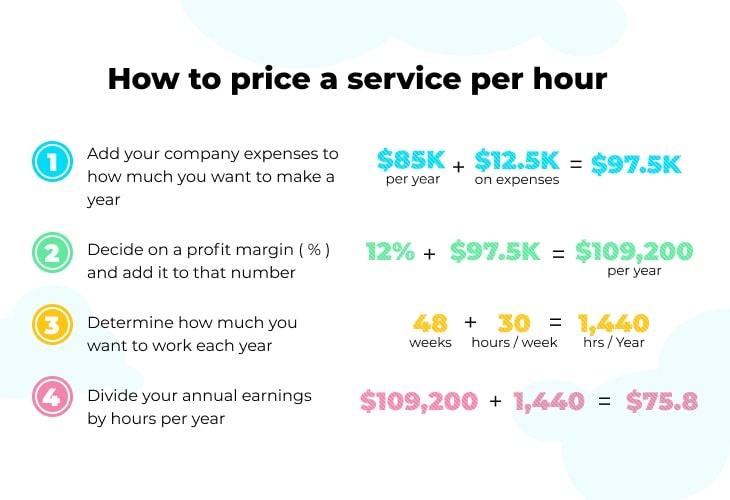

In this example, we’re going to assume you’re a self-employed graphic designer.

- Assess how much you’d like to make per year and add any company expenses.

For example, $85,000 per year + $12,500 in company costs (we discuss how to sum up your expenses in the next section) gives us $97,500.

- Decide on a profit margin (%) and add it to your salary & expenses.

A profit margin of 12% + $97,500 gives us $109,200 per annum.

- How much do you want to work per year?

How many days off do you want to take? How many hours a week do you want to work? Say you want four weeks off, which gives you 48 work weeks. Also, you want to work 30 hours a week.

48 weeks x 30 hours per week = 1,440 hours per year.

- Divide your annual earnings by the number of hours.

$109,200/1,440 hours = 75.8 -> $76 per hour.

Some salary calculators also suggest adding 1% for each year you’ve worked in your profession.

The per-hour rate would be a good starting point, but you wouldn’t be done yet! Check how much others with a similar profile to yours charge clients. You can ask on Slack or Facebook communities, or run a Google search.

How do you calculate the cost of a job?

It can be tricky, as some business expenses are more apparent than others. Consider:

- All of your overhead expenses, like taxes, healthcare, insurance, retirement savings, utilities, internet, office or co-working space rent, and accounting services.

- Software costs and professional equipment. What software do you pay for? What are your hosting and domain costs? How frequently do you need to purchase a new phone or computer?

- Anything that doesn’t fall into the above categories – for example, the time it takes you to get up to speed on a new project, time and money lost on trying to convert clients, etc.

Bring all the expenses down to an annual cost. For example, if you purchase a new laptop every five years, divide the cost by five. Respectively, multiply any monthly subscription fees by 12.

What is a reasonable profit margin for a small business?

There are two main factors to consider – the industry you operate in and the type and level of competition you face.

What is the minimum profit margin for a small business?

Most experts online agree that small businesses should aim at a minimum profit margin of 7% (with anything between 7 and 10% being a very healthy score). Anything below this threshold means your company is facing a financial liquidity risk.

The only exception are companies operating in retail and FMCG (fast-moving consumer goods), as they face higher operational costs than others.

What is a good profit margin for a first year small business?

Here’s something you might not be prepared for in your first year – your profit margins might be way higher than the 7-10% range above. How so? When you kick off your business, you don’t have that many costs yet. For example, you might start off as a solopreneur and only start outsourcing part of your work after several months.

Over time, as you grow your operational costs and/or workforce, you’re likely to see your profit margins drop closer to the average range for small companies.

Pricing services – finding the best approach

While it takes time to understand how to price a service correctly, it’s arguably the most important decision you make as an entrepreneur. Consider not only the market situation and your competitors’ rates but also what earnings will keep you motivated to grow the business.

To make sure you’re always charging the right rate, monitor your industry and overhead costs regularly. If necessary, go back to the drawing board and adjust your prices. Good luck in your business endeavors!