Getting paid on time is crucial for small business owners. If clients don’t pay invoices on time, or only pay when they are overdue, it can seriously hurt your cash flow and put your business at risk.

If you have outstanding invoices that are 90 days past due, it may be time to take action. Don’t let unpaid invoices pile up. Use these tips to start collecting payment on those due invoices and get the money your business deserves.

The problem of unpaid invoices for small businesses

Unpaid invoices can quickly become a nightmare for small business owners. Not only do they negatively impact your cash flow, but chasing payments takes up valuable time that could be better spent running your business or finding new clients.

The longer an invoice goes unpaid, the less likely you are to collect the full amount owed. After 30 days, your chances of collecting payment drop dramatically, and after 90 days, you’ll be lucky to recover even half of what’s owed. That’s why it’s critical to stay on top of overdue invoices from the start.

Research shows that 54% of small business owners are plagued by unpaid invoices, with 33% of invoices overdue by a month, and 20% going unpaid for 60 days or more. According to our own internal data, those numbers drop significantly when you replace manual invoice management with business management software. On average, vcita users get paid within 14 days, compared with over 30 days for manual invoice processing.

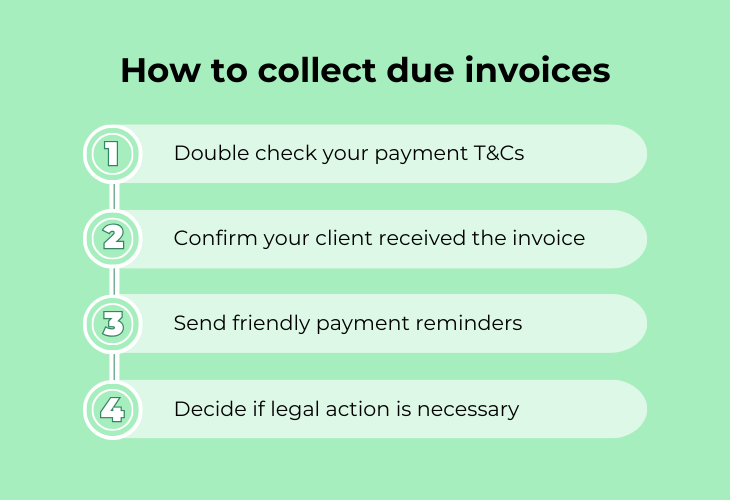

How to collect due invoices

Although there’s no way to guarantee that everyone will pay you on time, there are steps you can take to improve your chances of getting paid quickly. Begin by double-checking that your payment terms and methods are clearly stated on all invoices, preferably within 14 days. Also, confirm that clients received and approved the invoice. Sometimes invoices get lost or payments are held up by someone else in the approval chain.

If an invoice is still unpaid after 30 days, it’s time to start sending friendly payment reminders. Call your client, send an email, and re-send the physical invoice if needed. Be polite yet firm, restating your payment terms and the exact amount owed. You might want to offer payment options like installments or credit card payments, to make it easy for them to pay at least part of the balance right away.

After 60-90 days with no payment, you’ll need to decide if legal action or collections is necessary to recover the debt. As a last resort, you can hire a collections agency to collect long overdue invoices for a percentage of the amount they recover. However, for most small business owners, the time and legal fees often aren’t worth the trouble for smaller debts. In these cases, it may be best to write off the loss and make a note not to work with that client again in the future.

Following up on unpaid invoices with friendly reminders

Sending friendly payment reminders can help you get paid before invoices become overdue, and save you from having to take legal action. Be polite yet straightforward in stating the exact amount due and invoice number, and let them know their payment options like online payment, checks, or wire transfers.

You’ll want to send the first one a week before the payment is due. This can be a simple email reminding your customer that the amount owed will be collected in about 7 days. If after 15-30 days the invoice remains unpaid, send another friendly email. This time, explain that as a small business, collecting payment for services rendered is important to keep things running. Ask if there are any issues with the work, and offer to set up a reasonable payment plan so they can pay installments if needed.

After 60-90 days without payment, it may be time to get stern. Call your customer to discuss the situation. Explain that outstanding invoices create cash flow problems and you may have to take further action to recover the debt. See if you can work out a payment agreement over the phone. If that doesn’t work, you’ll need to decide whether to use a collections agency, take legal action or write off the loss.

When to take legal action for unpaid invoices

While sending friendly reminders and offering payment plans are good first steps, sometimes you have to take further action. If a final demand for the amount owed is ignored after 90 days past due, it may be time to consider legal action. Here are some options that you can take to encourage late payers to pay up.

Pursue a collections agency

Hiring a collections agency is usually the last step before going to court. An agency will attempt to collect the debt for a percentage of the amount collected. They have experience negotiating payment options with clients and may be able to recover at least part of the amount owed. However, the agency’s fees reduce the amount you ultimately receive.

Send a demand letter

Before you file a lawsuit, send your client a formal demand letter that restates the details of the overdue invoice and payment reminders that you sent. Demand immediate payment in full within a specified period, such as 14 days, and explain that if they fail to pay, you will have no choice but to initiate a lawsuit to recover the amount owed. If you’re unsure how to structure this, reviewing an example of letter before action can help you clearly communicate your intent and next steps. In some cases, a strongly worded demand letter is enough motivation for a client to send payment.

File a lawsuit

If other collection efforts have failed and the amount owed is substantial, filing a lawsuit may be your only option to recover the loss. While the process can be time-consuming and expensive, a binding decision from a judge may force the defendant to pay at least part of what they owe. Talk to a lawyer about the merits of your specific case and the proper procedures for filing a claim in your local small claims or district court.

As a small business owner, collecting on unpaid invoices is important for your cash flow and financial health. Exhausting all options before pursuing legal action often makes sense. However, in some situations, you have to take a stand to avoid clients taking advantage of your payment terms and goodwill. Know when it’s time to get tough for the good of your business.

Using a collections agency to recover unpaid invoices

If friendly payment reminders don’t work and an invoice becomes 90 days past due, it may be time to get help collecting what you’re owed. Hiring a collections agency is an effective way to recover outstanding invoices while minimizing the time and stress on you.

Collection agencies are professionals who specialize in recovering delinquent debts and unpaid bills. They have the experience, resources, and techniques to collect payment for overdue invoices when you’ve hit a dead end. Collection agencies will handle the entire collection process on your behalf, from sending official notices to negotiating payment plans to taking legal action if necessary.

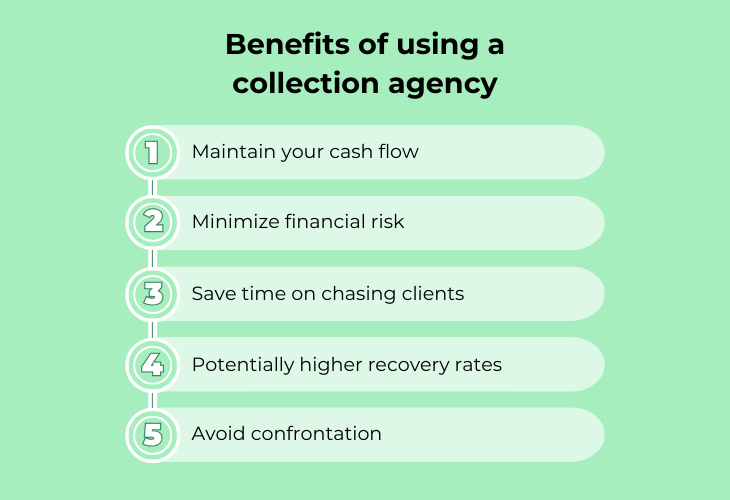

The benefits of using a collections agency

With the help of a reputable collection agency, small business owners have a better chance of maintaining steady cash flow by recovering unpaid invoices and minimizing bad debt. Here are some of the benefits of using a collections agency for small business owners:

- Maintain cash flow. Recovering unpaid invoices means money in your bank account and a healthier cash flow.

- Minimize financial risk. The longer an invoice goes unpaid, the less likely you are to collect the full amount owed. Collection agencies help recover debts before they become uncollectible.

- Save time. Collections agencies handle the time-consuming process of reaching out to clients, sending payment reminders, and negotiating payment options so you can focus on running your business.

- Potentially higher recovery rates. Collection agencies have the expertise and legal means to recover a higher percentage of unpaid debts compared to individual business owners.

- Avoid confrontation. Using a third-party collection agency prevents confrontation and conflict with your clients which could damage your professional relationship.

When vetting collection agencies, look for ones experienced with recovering debts for small service businesses like yours. Check reviews from other business owners and compare fees and collection rates. A good agency should be able to recover at least 60-80% of your outstanding accounts receivable, for fees of around 20-50% of the amount collected.

Stop overdue invoices from threatening your business

Having overdue invoices can hurt your cash flow, so don’t let debt go uncollected. Staying on top of due invoices and offering multiple payment options and terms will help ensure you get paid for your services. With diligent and consistent follow-up, you can recover most of the money owed and avoid losing customers in the process.