As a small business owner, you pour your heart and soul into building your company. You work late nights and long hours to acquire new customers. But do you know how much it costs you to gain each new client? Are you spending more to attract clients than your clients spend on your services?

Understanding your client acquisition cost, or CAC, is critical to scaling your business profitably. It refers to the total amount of money you spend to attract a new customer, and includes expenses like marketing, advertising, and sales. By calculating your CAC, you gain insight into which lead generation tactics are cost-effective and which aren’t worth the investment.

What is client acquisition and why does it matter?

Client acquisition refers to the process of gaining new customers or clients for your business, so knowing your client acquisition cost – how much it costs you to gain each new customer – is critical. If your CAC is higher than the lifetime value of your average customer, you’ll lose money in the long run.

For example, if it costs you $500 to gain a new client, and your average customer lifetime value is $2,000, then you have a healthy 4:1 ratio, and the money spent acquiring new clients is worthwhile. But if your cost per acquisition is $2,000, and your average customer lifetime value is only $1,500, you’ll lose money. You need a CAC that’s sustainable for your business model.

Tracking your CAC also allows you to optimize your marketing and sales strategies over time. Once you know your CAC, you can double down on the channels and campaigns that attract marketing qualified leads, or MQLs, and turn them into new clients at an affordable price, and make changes to the ones that aren’t delivering the results you need.

Calculating your client acquisition cost

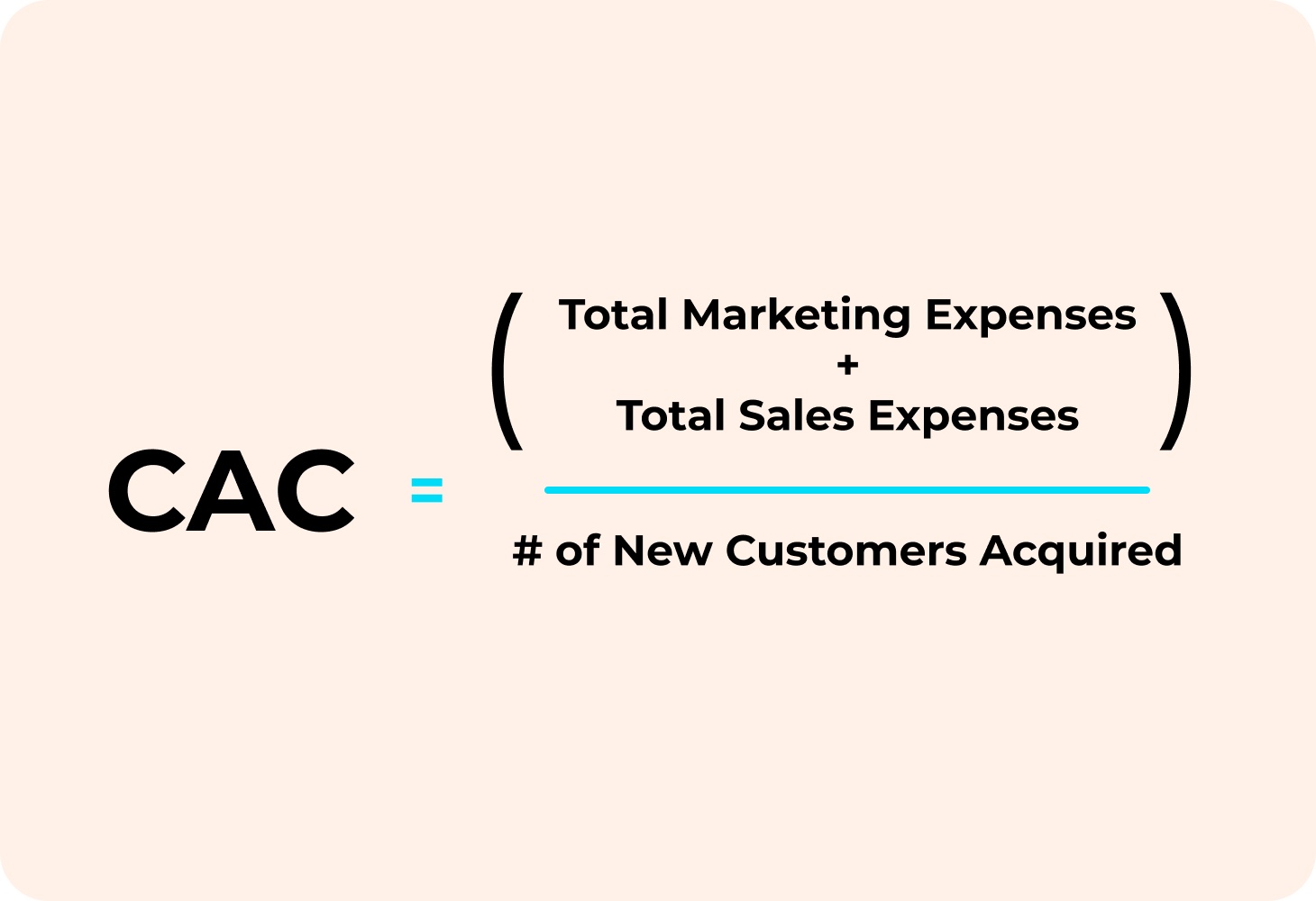

To calculate your CAC, divide your total customer acquisition expenses by the number of new customers acquired.

First, you need to add up all your expenses, which include things like:

- Marketing costs (ads, content creation, social media, etc.)

- Sales expenses (sales team salaries, travel, etc.)

- Promotional offers (discounts, free trials, etc.)

Now look at the number of customers you generated as a result of these expenses. Lets say you attracted 2000 new MQLs, and they converted at a rate of 10%, so you ended up with 200 new customers.

Finally, divide your expenses by the final number of new customers you acquired. For example, if you spent $40,000 on marketing and sales last month and acquired 200 new customers, your CAC would be $40,000/200 = $200.

It’s also a good idea to track the specific marketing channels that convert best, and calculate CAC for each channel separately. This helps you double down on effective approaches and eliminate poor performing ones.

Optimizing your client acquisition strategy to drive growth

Optimizing your client acquisition strategy is key to driving growth for your small business. Tracking your CAC allows you to see how much you’re spending to acquire each new customer, which is the best way to check if your client acquisition strategies are effective.

If your CAC is too high, you need to look for ways to optimize your marketing and sales processes. You might try:

- Improving your social media targeting to reach high-intent customers.

- Creating automated email nurture campaigns to move leads through your sales funnel.

- Training your sales team to have more effective initial calls with prospects.

- Adjusting your messaging to better resonate with your target customers.

- Investing more in encouraging happy customers to refer you to friends and family.

On the other hand, if your CAC is relatively low, that means that you can afford to spend a bit more on your marketing channels, especially since you’ve already proven that they are effective. This increases the number of MQLs you attract, creating a virtuous cycle of growth. It also gives you more budget to provide exceptional customer service, leading to higher retention and more referrals. customer support service provider can help you optimize your client acquisition strategy, driving growth for your small business while attracting more MQLs to fuel your expansion and provide resources for exceptional customer service.

Business success relies on smart client acquisition

Focusing on optimizing your client acquisition strategy by lowering your CAC and improving lead conversion is one of the smartest choices you can make as a small business owner. Tracking your CAC also allows you to set revenue targets to ensure your business remains profitable, and gives you data to make smarter decisions about spending and growth. While it may seem like just another business success metric, your client acquisition cost has a huge impact on your bottom line, so it’s worth the time to calculate and monitor it.