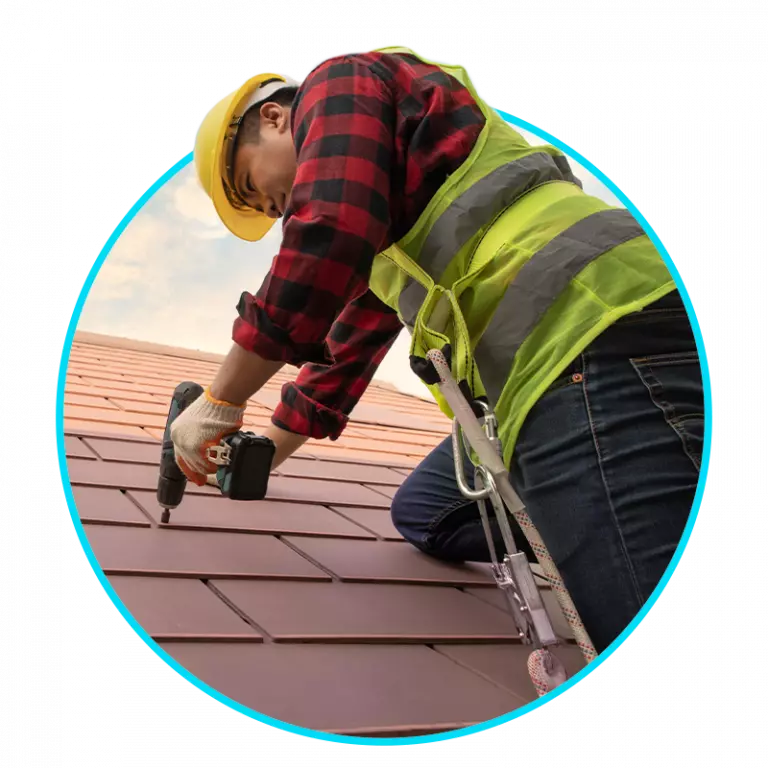

Streamline your operations with our small business finance management software

In the early days of running a business, it can feel like you’re constantly swimming in a sea of numbers. There’s the cost of products and services sold, overhead expense, employee salaries, inventory levels…the list goes on. And on top of all that, you have to keep track of what’s coming in. It’s a lot to keep in line, and if you’re not careful, it’s easy to lose sight of the big picture.

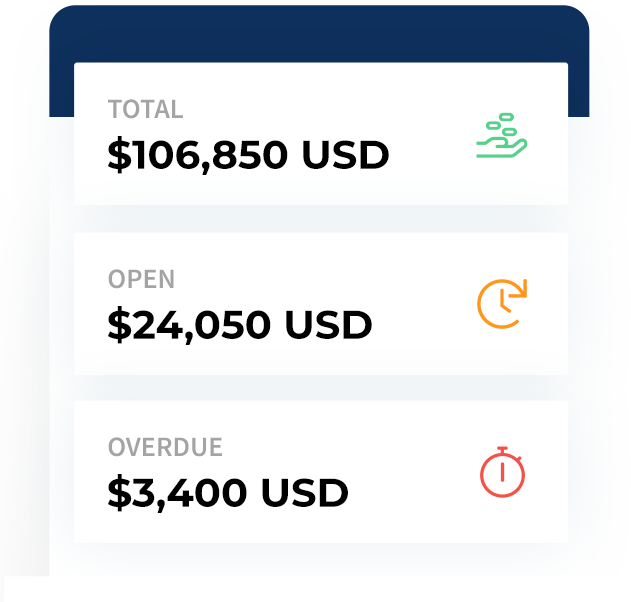

Luckily, vcita’s small business finance management software gives you all the key features and workflows you need to stay on top of your finances so you can better project for your business’s future. Use detailed reports and an intuitive dashboard to see how your business is accounting for its operations. Automatically generate and send estimates, bill invoices, and get paid on time (and in real-time) with automatic payment reminders. For your business side, integrate with other different accounting software applications to create financial statements.

You’ll never fall behind again — vcita’s app has all the features your business needs to grow and succeed.