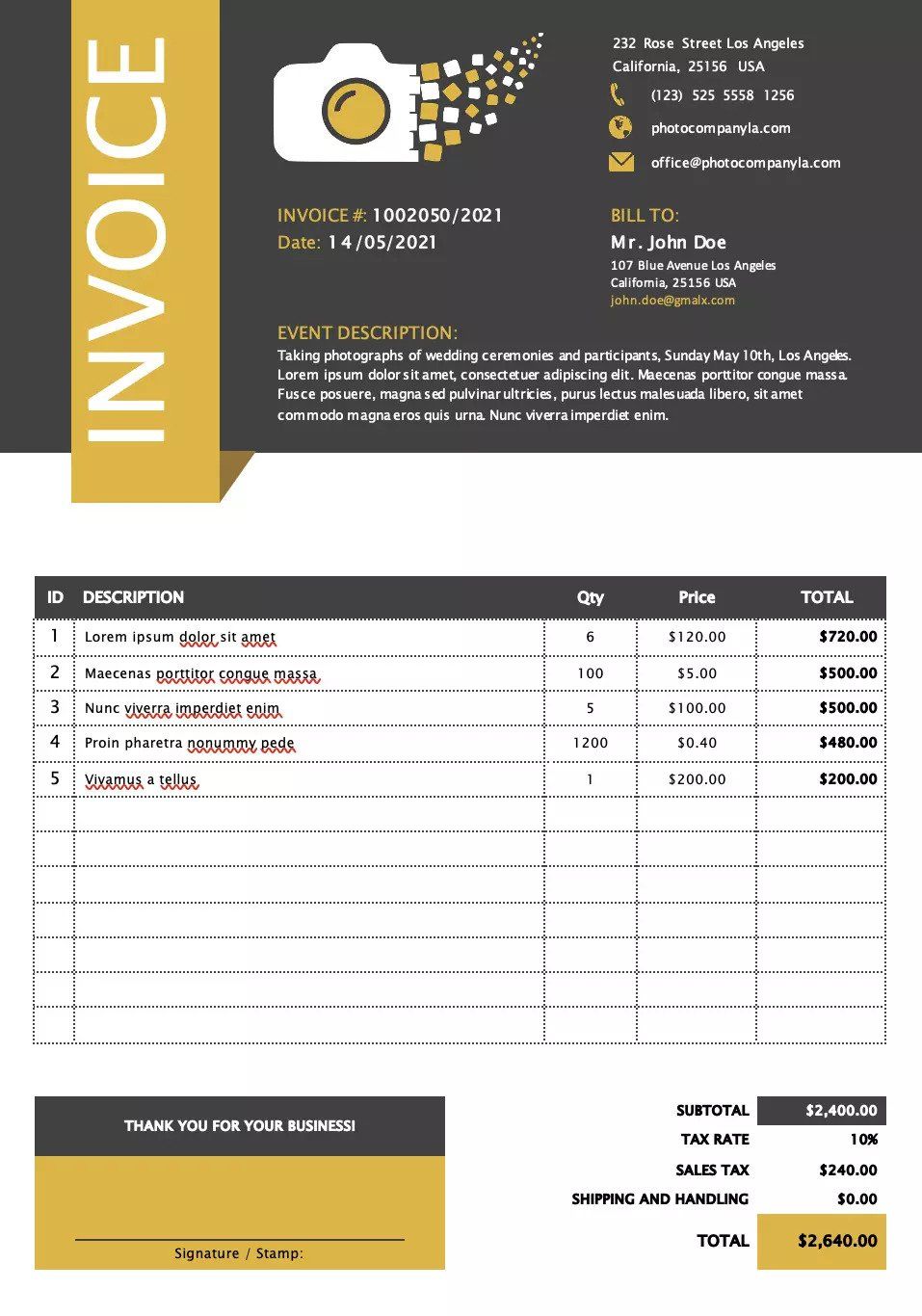

Free invoice templates

More than 25 professional invoice templates for word and excel

vcita introduces a new, more simple way to manage invoices and collects payments.

Schedule a free, personalized demo

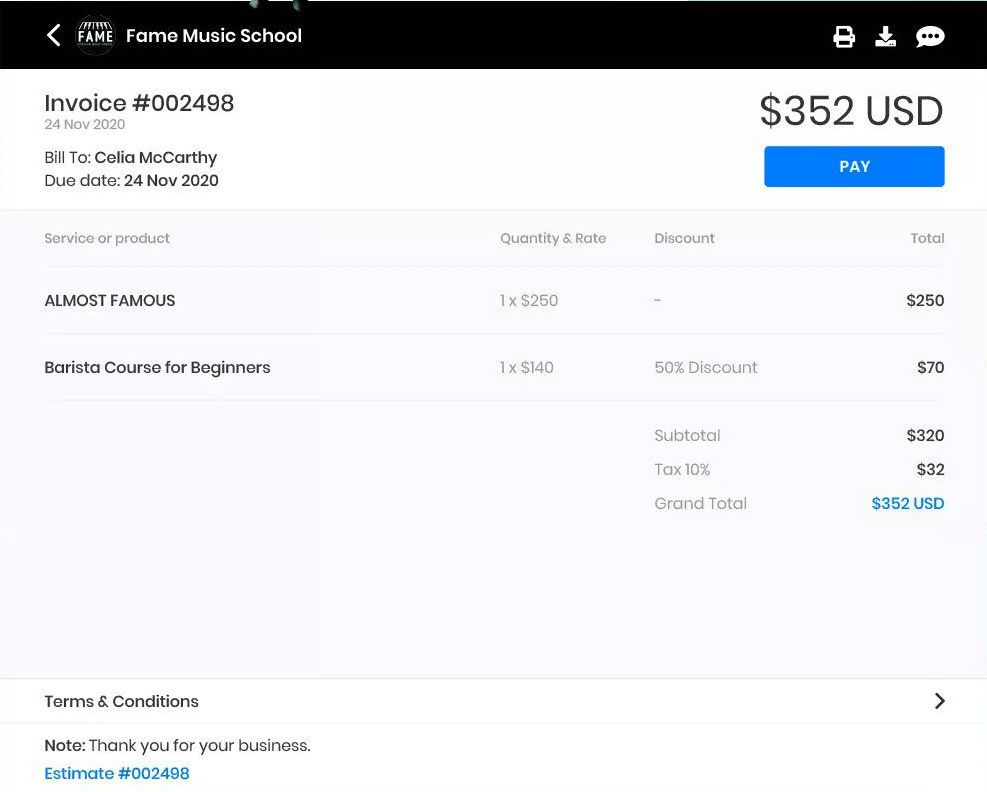

Make payments easier with invoices from vcita.

Connect to a payment gateway and send your client an invoice with ‘pay’ button.

For business owners

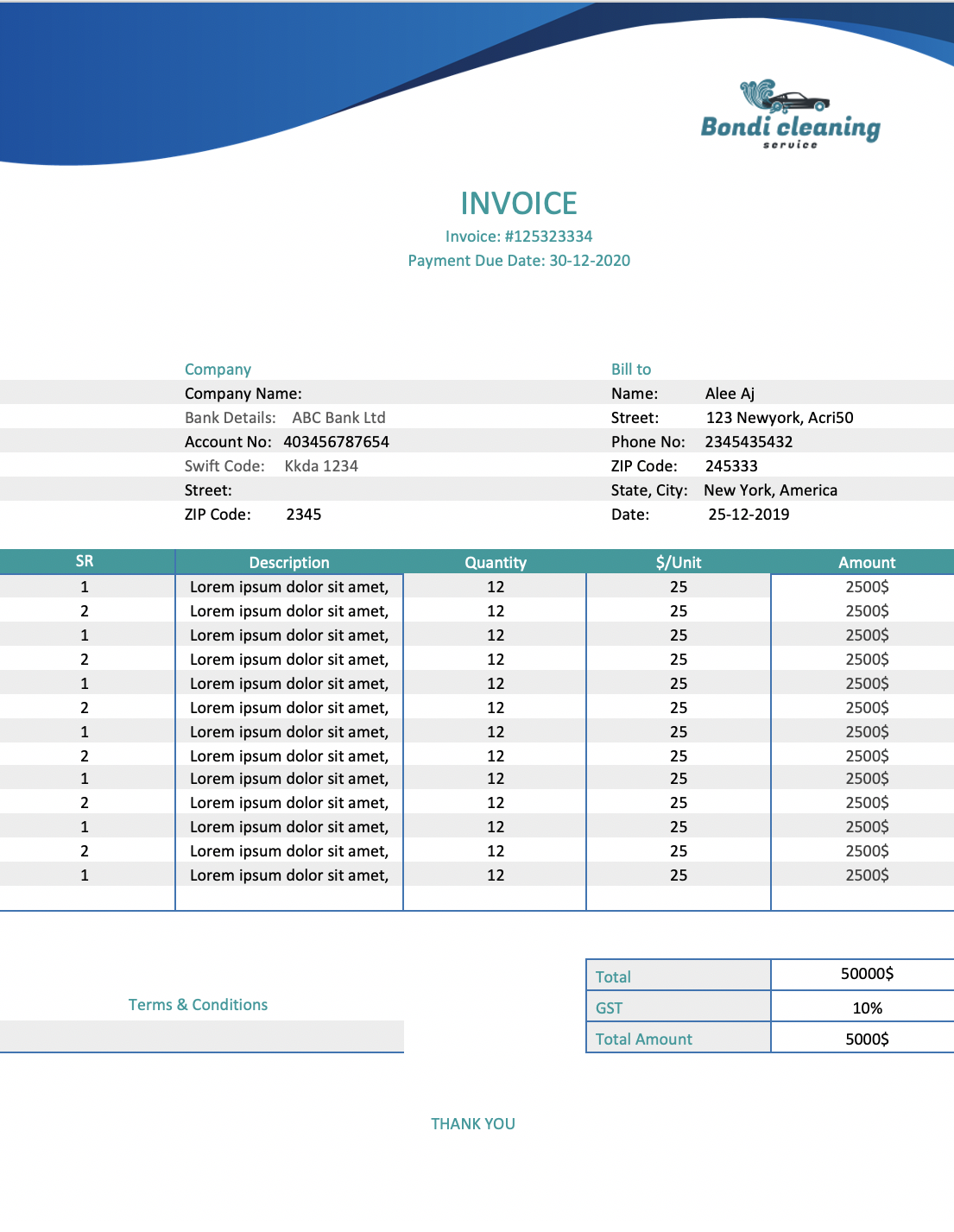

What it’s for: Our invoice template specifically designed for Australian entities that have an ABN (Australian Business Number) and include a GST (Goods and Services Tax, a 10% fee that sole traders need to charge if earning over AUD$75,000/year from a single business) amount. This template includes fields for GST calculation and amount, ABN number, contact details, invoice number and date, invoice items, payment details, and additional notes.

Who it’s for: This template is useful to sole traders and freelancers (who need to include the words “Tax Invoice” on their invoices), as well as registered businesses with an ABN, earning more than AUD$75,000 a year or simply wanting to register for the GST for any reason, even if their annual earnings are below the GST threshold. If you’re not registered for GST, you can leave this part out or just title it as “Invoice”.

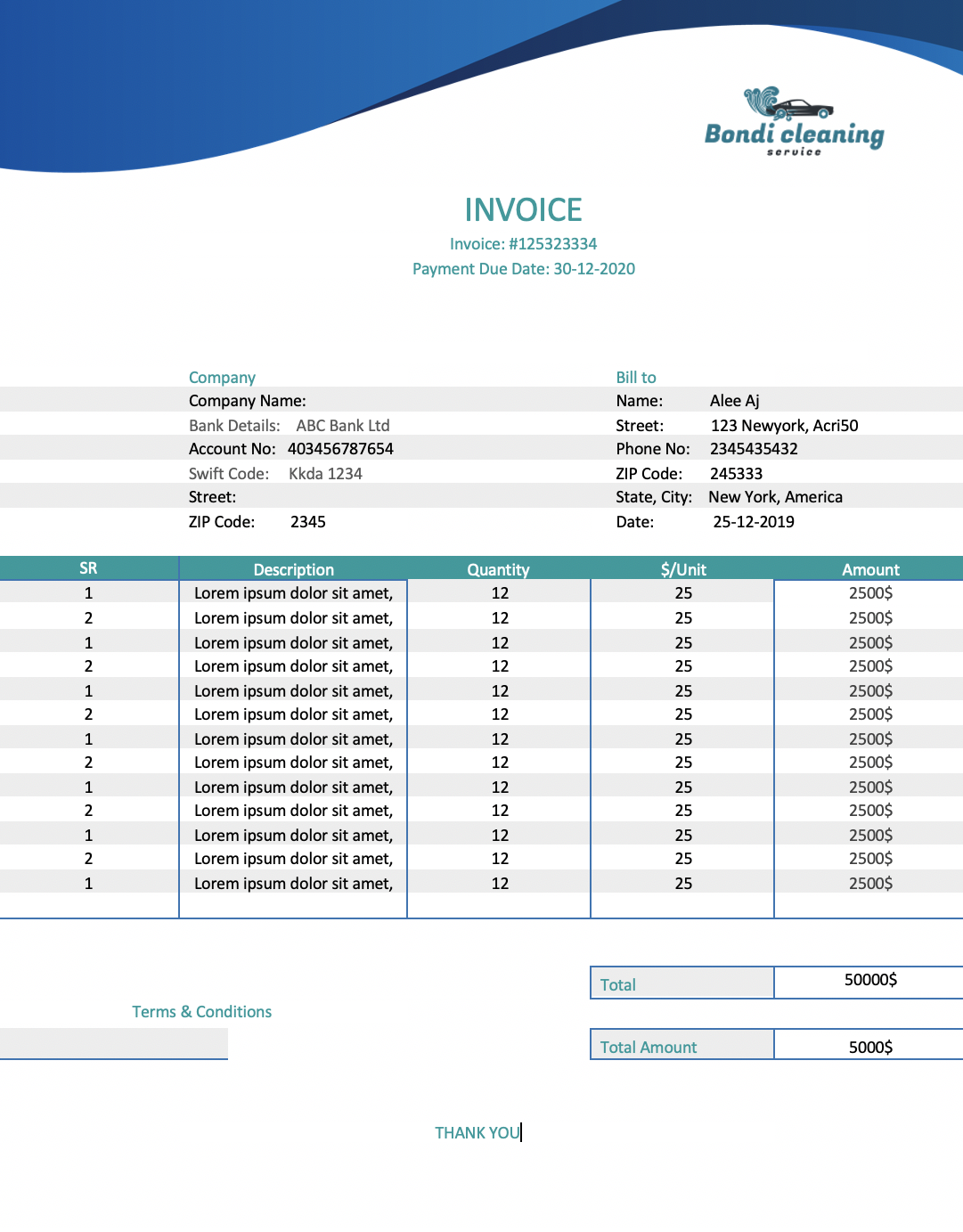

What it’s for: This invoicing template is designed for entities operating on Australian soil that don’t need to register or charge GST (Goods and Services Tax). The template includes all the other fields necessary for a complete invoice – contact information, invoice number and issue date, due date, invoice items and description, pricing, ABN (Australian Business Number – if you’re registered as a business), payment details, and additional notes.

Who it’s for: This template can be used by all sorts of small businesses, freelancers, and solopreneurs that operate on Australian soil and don’t earn more than AUD$75,000 in a single tax year from a single business. Do note that you have to register for GST when you’re approaching this threshold, in which case you should use an invoice template that has a GST field.

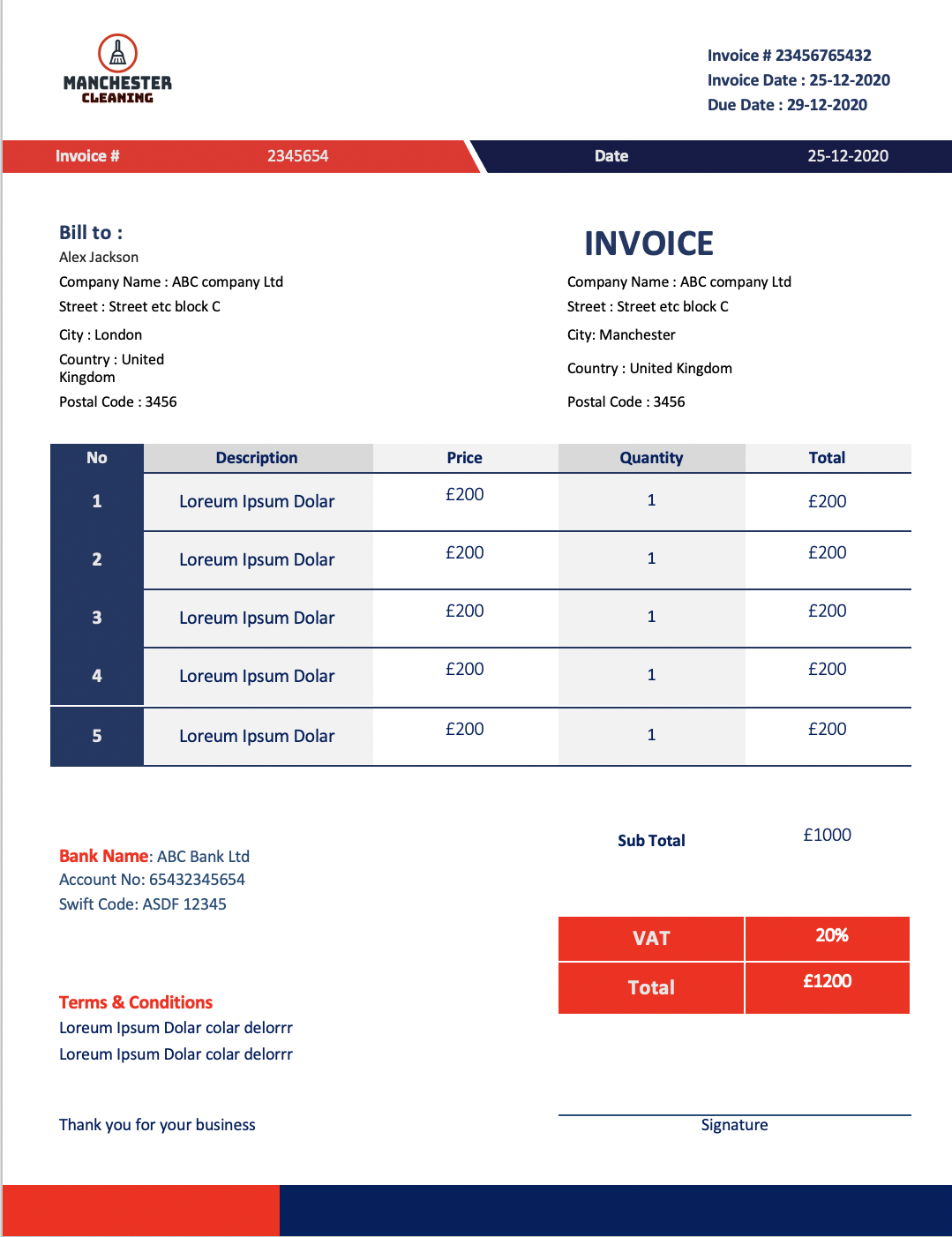

What it’s for: This invoice template is relevant for the area of the UK and it takes into account VAT (Value Added Tax), which is calculated as 20% of the cost for the provided services or goods, or 5% if these are reduced-rate goods or services. Some items are subject to 0% VAT but they still need to be reported as they’re not the same as VAT-exempt items.

In addition to featuring spaces for the VAT rates and amounts, as well as the supplier’s VAT registration number, our template allows you to input full contact details of both you and your client, invoice number and date, the list of items along with their description, prices, and additional notes.

Who it’s for: Businesses and solopreneurs (domestic or foreign) selling all kinds of services or goods to the UK customers that qualify for charging and reporting VAT. Service and goods providers are required to register an account for VAT on sales, purchases above specified limits, and production of taxable items if they earn more than £85,000 per year.

What it’s for: This template provides all the fields needed for invoicing services and items to your clients, including contact information, invoice number and issue date, due date, the list of items along with their description (quantity, length, etc.), prices, payment details, and additional notes – everything except the VAT (Value Added Tax) details, as these are only required for entities that need to charge or report VAT.

Who it’s for: Ideal for small businesses, freelancers, and solopreneurs operating on the UK soil that don’t need to charge VAT, such as those selling VAT-exempt items or whose earnings are below the turnover threshold of £85,000 per year.

What it’s for: This template was designed with the New Zealand-specific GST (Goods and Services Tax) in mind, which is why it includes fields for supplier GST number, GST rates and amounts (15% standard rates, 9% reduced rates), and an IRD number (unique New Zealand tax reference number provided by Inland Revenue).

Other built-in fields in our template include those for contact information of both sides (supplier and customer), invoice number and issue date, payment due date, item list with descriptions, quantity, rates, payment details, and additional notes.

Who it’s for: Businesses and solopreneurs (domestic or foreign) providing services or goods in New Zealand, with an annual turnover of more than NZD$60,000 and for invoices over the NZD$50 threshold. Do note that invoices below NZD$1,000 don’t need to include the customer’s name and contact information or detailed GST calculation. Tax invoice isn’t required for sales below NZD$50.

What it’s for: Our invoice template is ideal for invoicing your clients when you don’t need to input any GST (Goods and Services Tax) details. Instead, it focuses on all the other fields necessary to complete an invoice for the area of New Zealand, including contact information, invoice number and issue date, payment due date, item list with descriptions, quantity, rates, payment details, and additional notes.

Who it’s for: Various small businesses, freelancers, and solopreneurs (domestic or foreign) with customers in New Zealand, without the requirement to register GST, i.e. working part-time or generating or expecting to generate less than NZD$60,000 per year.

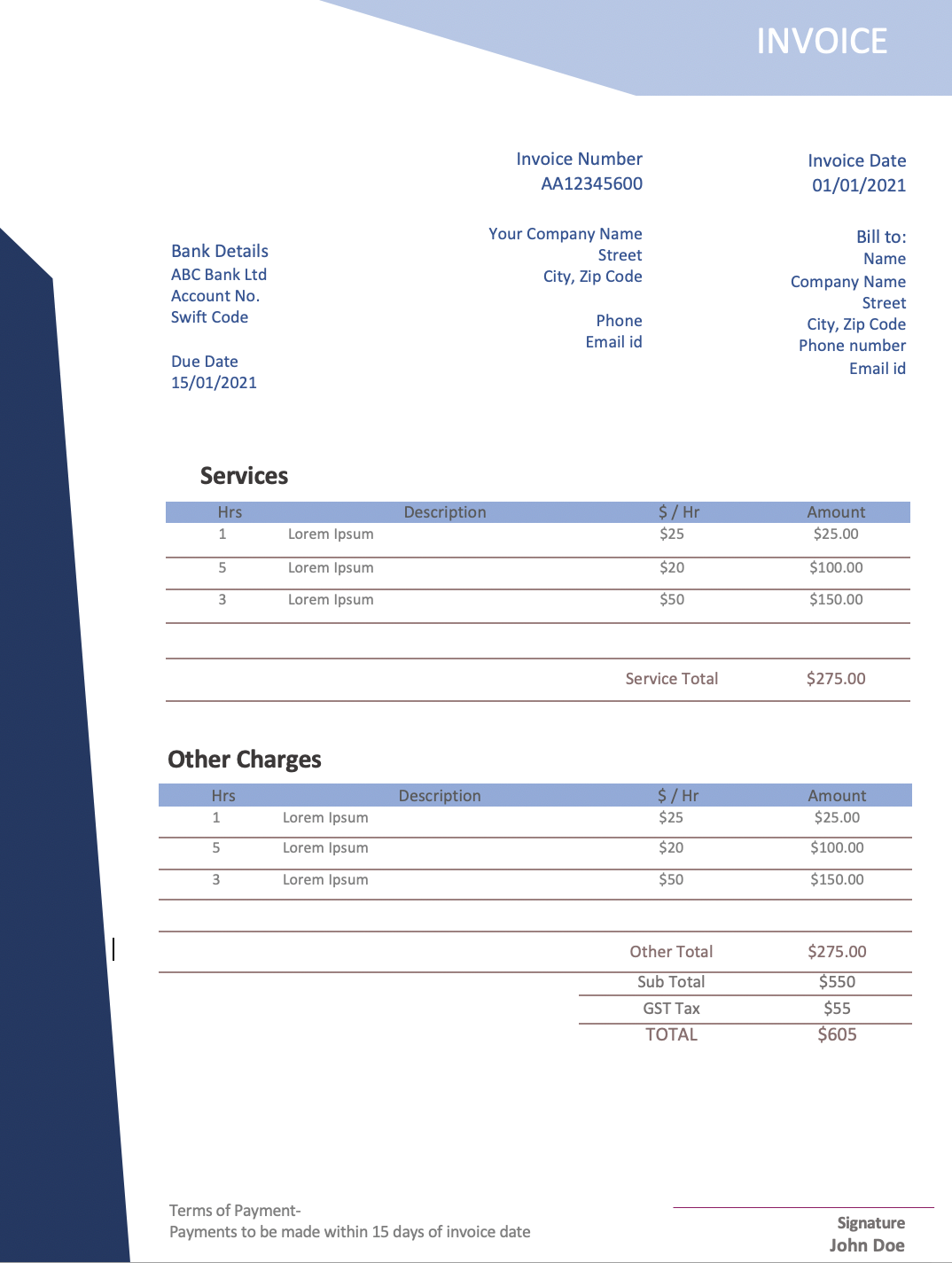

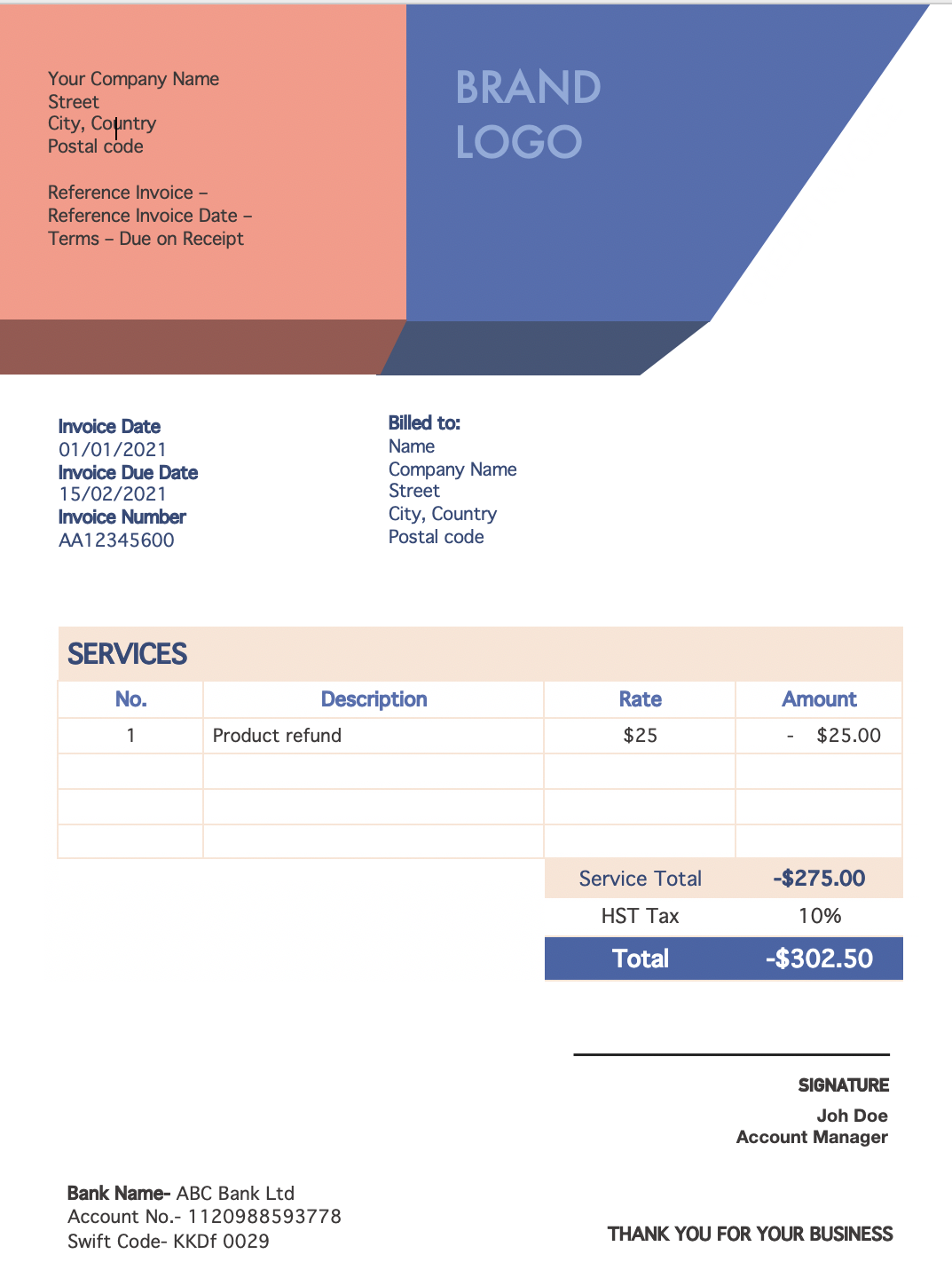

What it’s for: An invoice template that takes into account the Canadian Harmonized Sales Tax (HST), which is a combination of federal and provincial taxes on services and goods in five Canadian provinces. This rate is 15% in Nova Scotia, 13% in Ontario, New Brunswick, and Newfoundland/Labrador, and 5% in British Columbia.

In addition to providing a field for inputting the charged HST amount and GST (business) number, this template features fields for business and customer details, invoice number and date, business registration number, an itemized list of provided services or goods, quantity, prices, totals, and any additional notes.

Who it’s for: All sorts of businesses operating in Canada that are required to register and report HST, i.e. those whose earnings exceed CAD$30,000 in a single calendar quarter or over the previous four (or fewer) consecutive calendar quarters. Those below this threshold may choose to register for HST voluntarily.

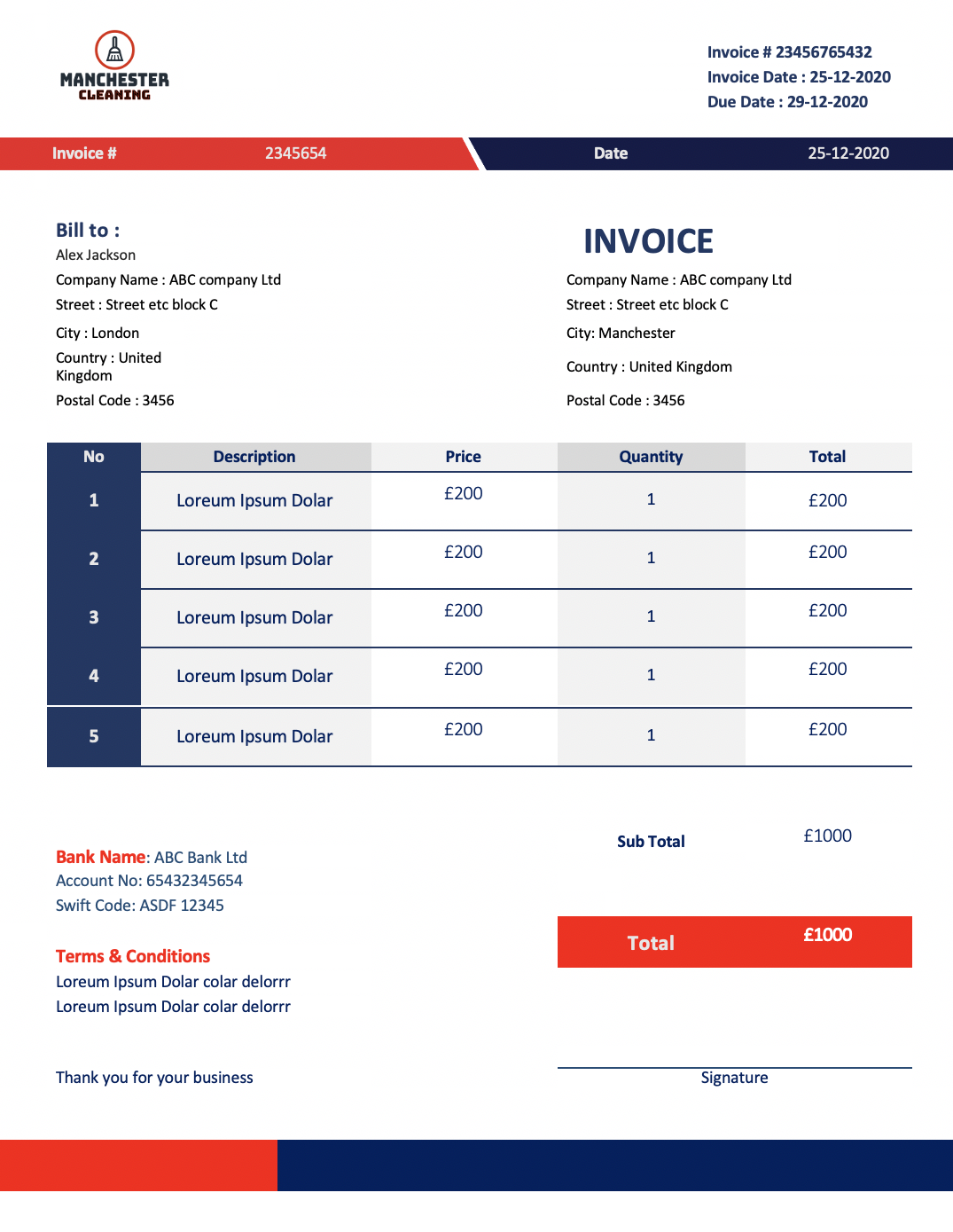

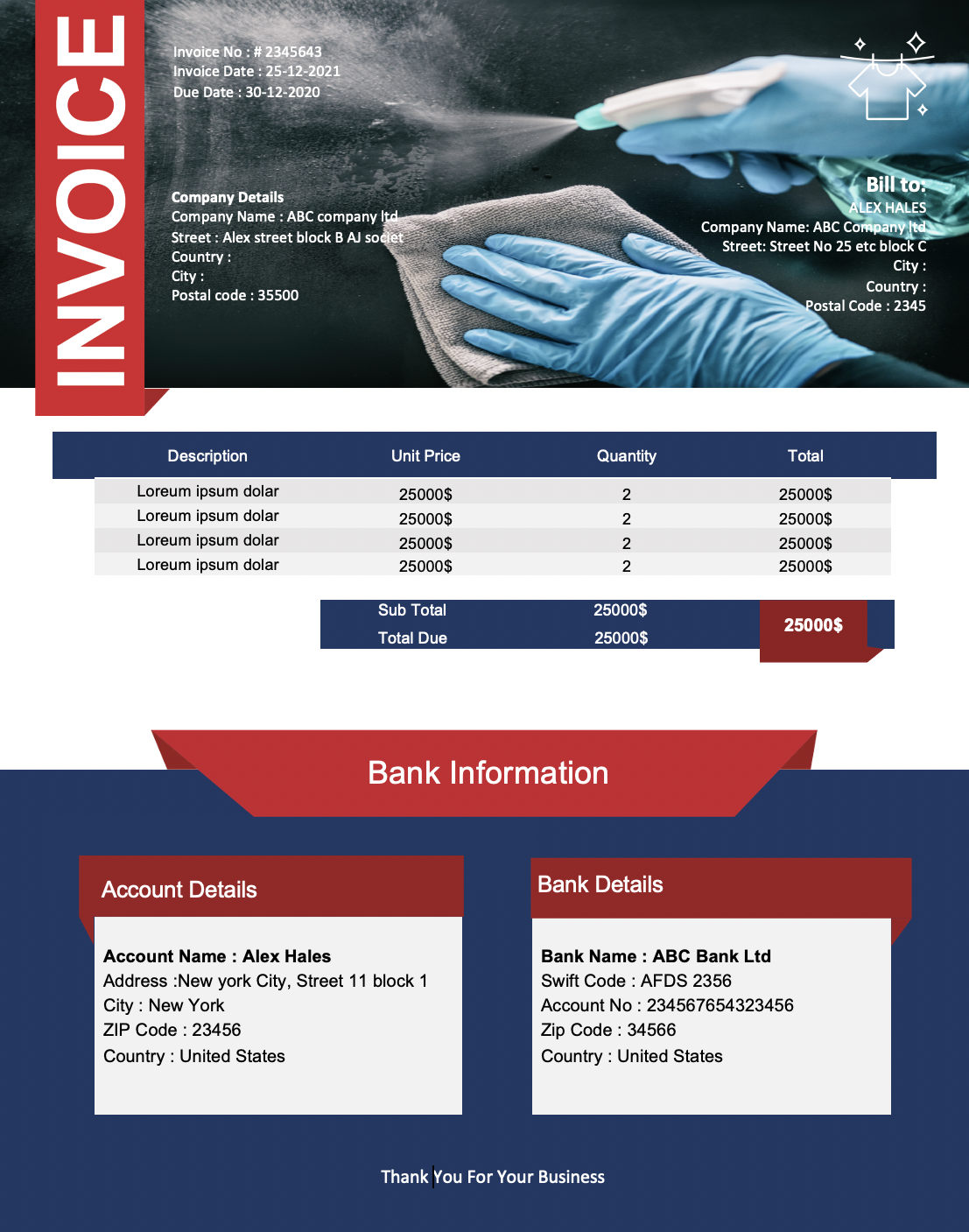

Invoice templates for cleaning businesses

Download our selection of free invoice templates for dry cleaning, office cleaning, carpet cleaning, window cleaning and many other invoice templates customized for cleaners.

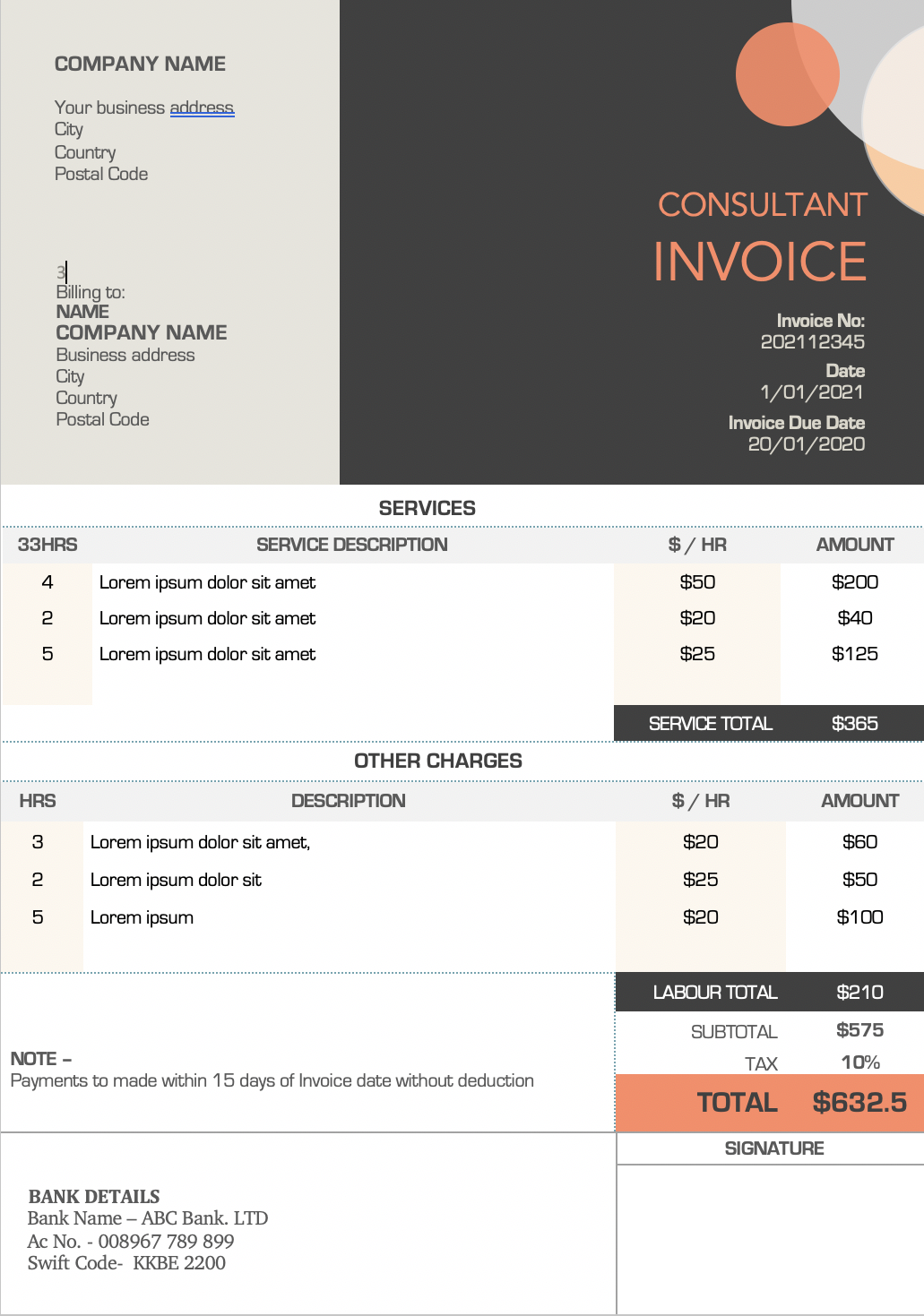

Invoice templates for consultant businesses

Download our wide selection of invoice templates for business consultants, legal consultants, SEO consultant, IT consultants, health consultants and many other invoice templates tailor made for consultants.

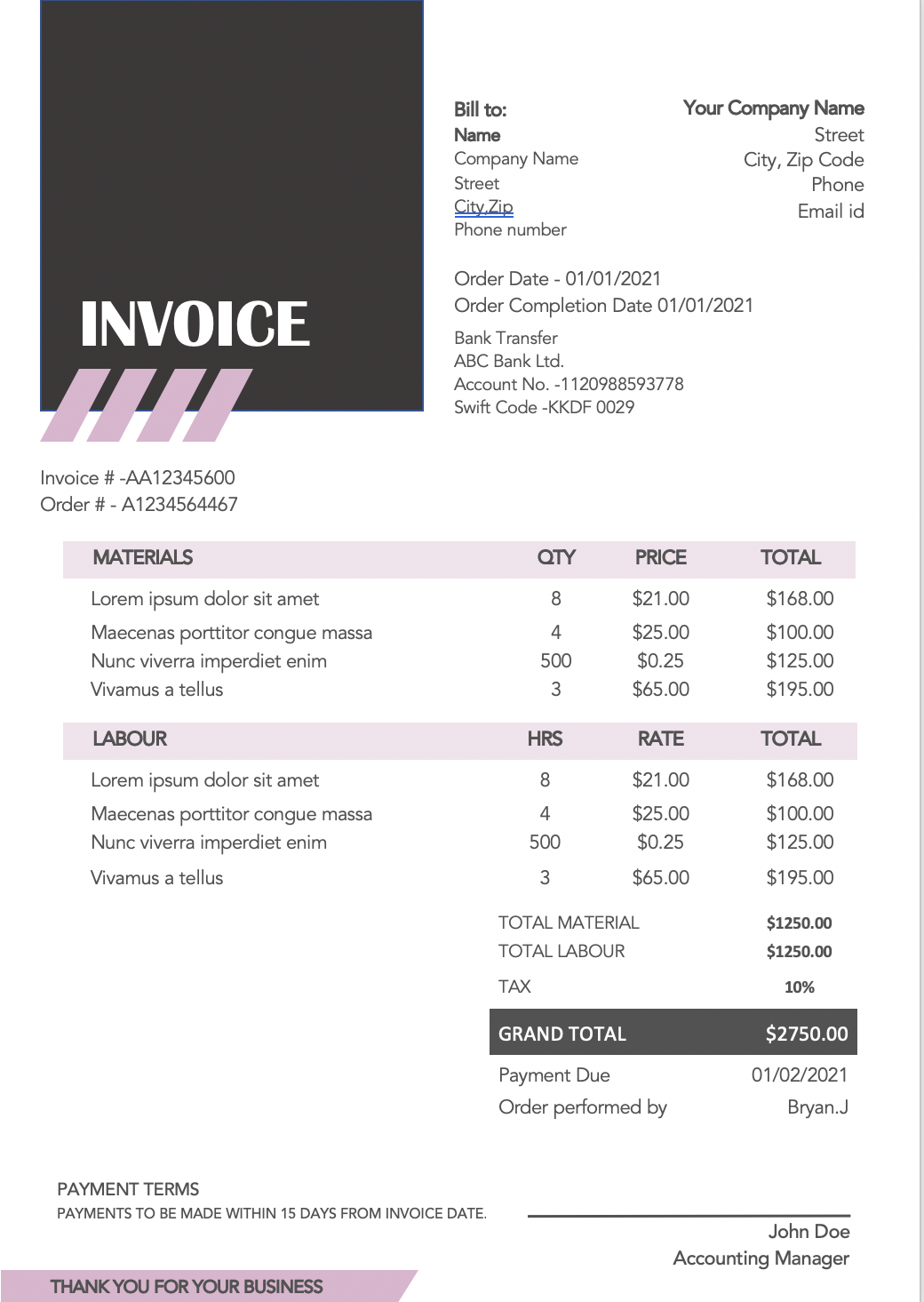

Invoice templates for contractors

See our selection of invoice templates designed for more than 10 different types of service contractors:

Electric contractors, roofers, landscapers, home repair contractors, design contractors and many other types of contractors.

Add name, address, phone, email, and website.

Drop in your business logo, colors, fonts or other graphics that speak your brand language.

This should be a unique number that you can use for tracking.

The date when you plan on sending the invoice.

When payment is due—make it bold!

Add their full name, address, email, or phone number.

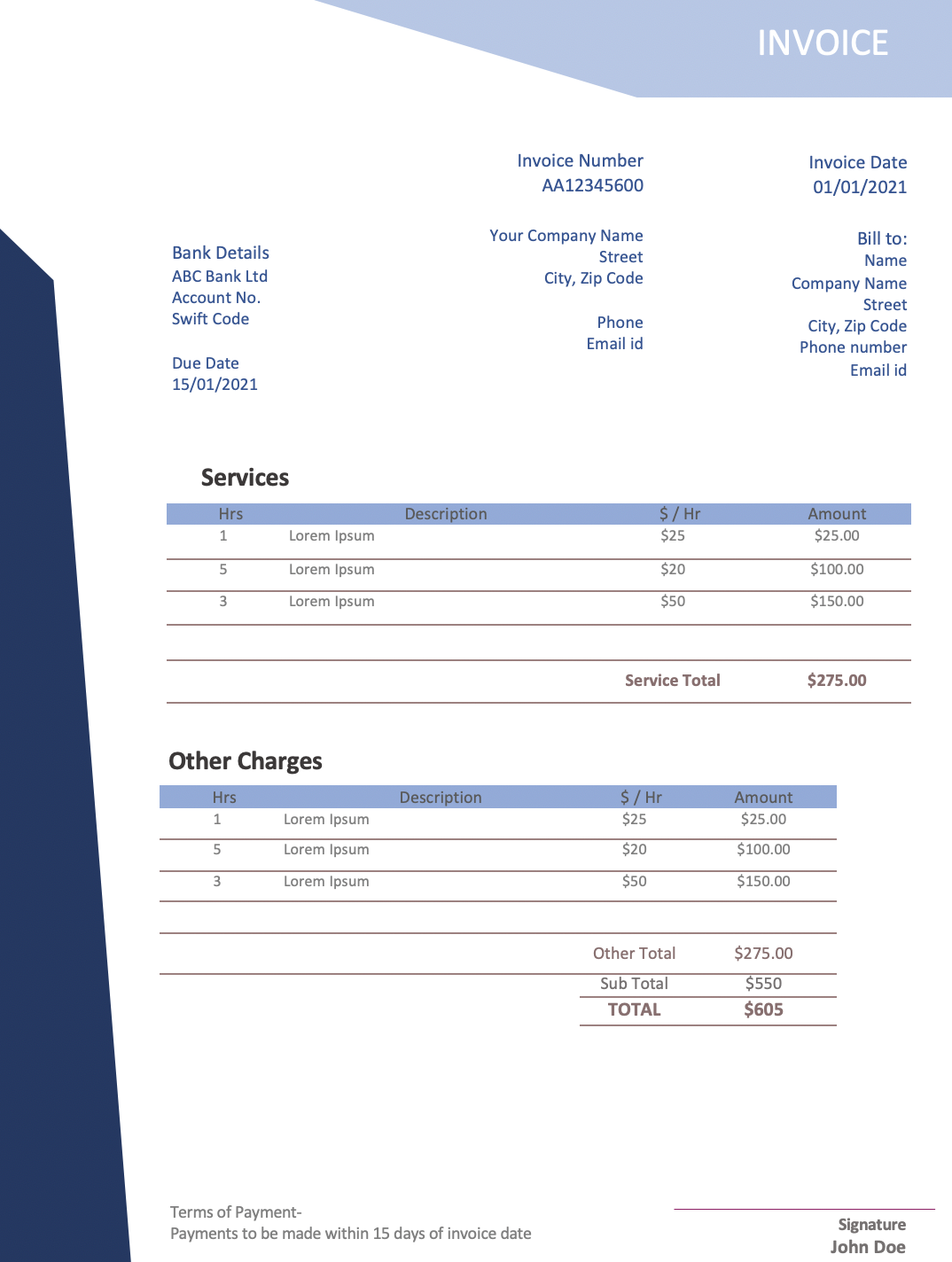

Our ‘Standard invoice’ contains 2 tables, one for hourly services and one for items. List each item or hourly service you need to bill for.

Add your hourly rate or item price on each line, and the total amount for each one. This makes it easy for your client to see how you’ve calculated the total.

If you’re charging sales tax, add it in the tax field before the total amount due.

This is the place to add late payment fees and other conditions that may apply.

For safety & security reasons we highly recommend saving and sending the file as a locked PDF, not the original file.

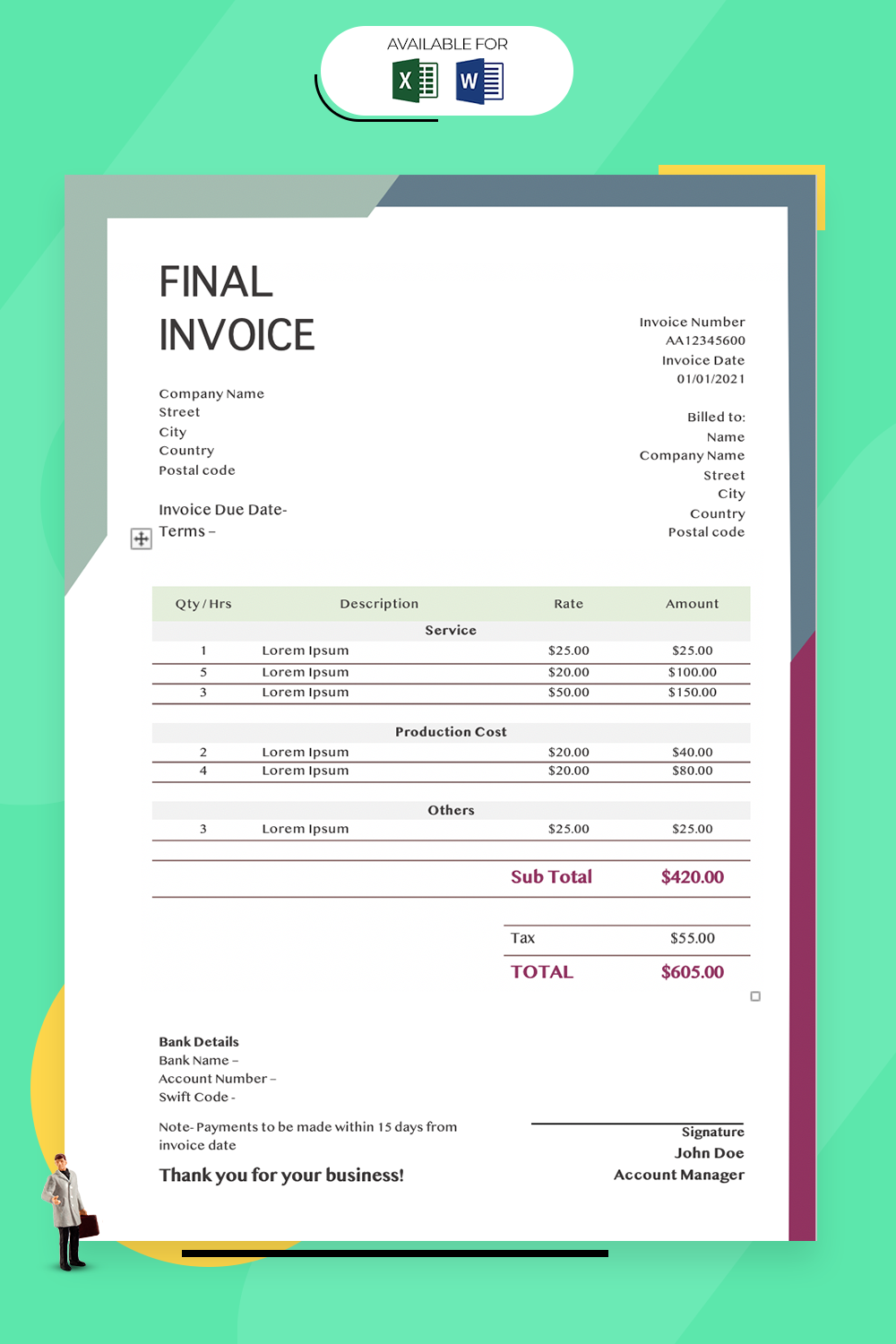

Package of 13 invoice templates for Microsoft Excel in .Docs format

With so many templates to choose from, it’s tough to choose just one! Narrow down your choices by making sure your invoice fits:

Choose an invoice that fits the invoicing conventions of your industry. For example, legal invoices usually have a serious, professional look, while a florist might go for something a little more decorative. Although stepping out of the box can be worthwhile sometimes, your invoice shouldn’t stray too far from what your clients expect. Fortunately, we’ve organized our invoice templates by common industries we work with, to make your search easier.

As you’re looking through invoices, pick one that fits your business type. If you design sleek websites for corporate clients, your invoice should probably look a little like your design work: highly polished and professional. But if you design beer labels, it’s probably better to go with a more casual look. Choose the invoice template that fits your business niche within the larger industry.

Successful business owners know that having a unique angle can set you apart—usually, it’s captured in your brand voice. Make sure your brand shows up on your invoice too! Choose an invoice template that you feel comfortable modifying with your logo, brand colors, and signature fonts.

Excel gurus will swear by Excel for just about everything, but you can make a great invoice in Word too. It just depends on what you need. If you’re invoicing for a lot of smaller items, Excel is your friend. You’ll be able to use excel functions to calculate the totals of each individual item, then add tax. If you just invoice one larger amount and you’re not crazy about Excel, use Word to create simple invoices that are a little more user friendly. Whatever format you choose, make sure to save it as a .pdf before you send it to your client, so the content can’t be altered.

This goes hand-in-hand with what format you should choose. When you’re invoicing an hourly service, you’ll need a space for the number of hours and amount per hour you charge. If you’re selling a product, you need spaces for the total price of each item and its ID number. Make sure that there’s space on your invoice for all the details you need to include, given what you’re charging for.

Invoicing FAQ

What is an invoice?

What is a bill only invoice?

How do I get clients to pay me on time?

What are the standard invoice payment terms?

How do I let clients know I’ve received their payment?

How do I invoice if I’m not VAT/GST registered?

What do I need to include on my invoice?

Can I switch up the format?

How often should I invoice?

Smart billing and invoicing with

a powerful all-in-one business app

Boost your cash flow with smart billing and invoicing, now made easy with vcita’s all-in-one business app – a powerful yet simple app that helps you manage your time, money, clients, and marketing. With vcita you can do so much more than just creating invoice templates.

Add your logo and company information, currency, tax rates and discounts, to create professional invoices that your clients can understand and pay quickly.

Quickly create and send estimates, invoices and receipts and let your clients pay directly from an estimate or invoice. vcita’s business app uses smart invoices that auto-populate with the latest services and packages you provided your clients.

Allow your clients to settle their bills directly from their mobile phones. Just send them a payable link directly to their email or text so they can pay with a couple of taps.

Not sure? Schedule a demo

Copyright 2026 vcita Inc. All rights reserved.