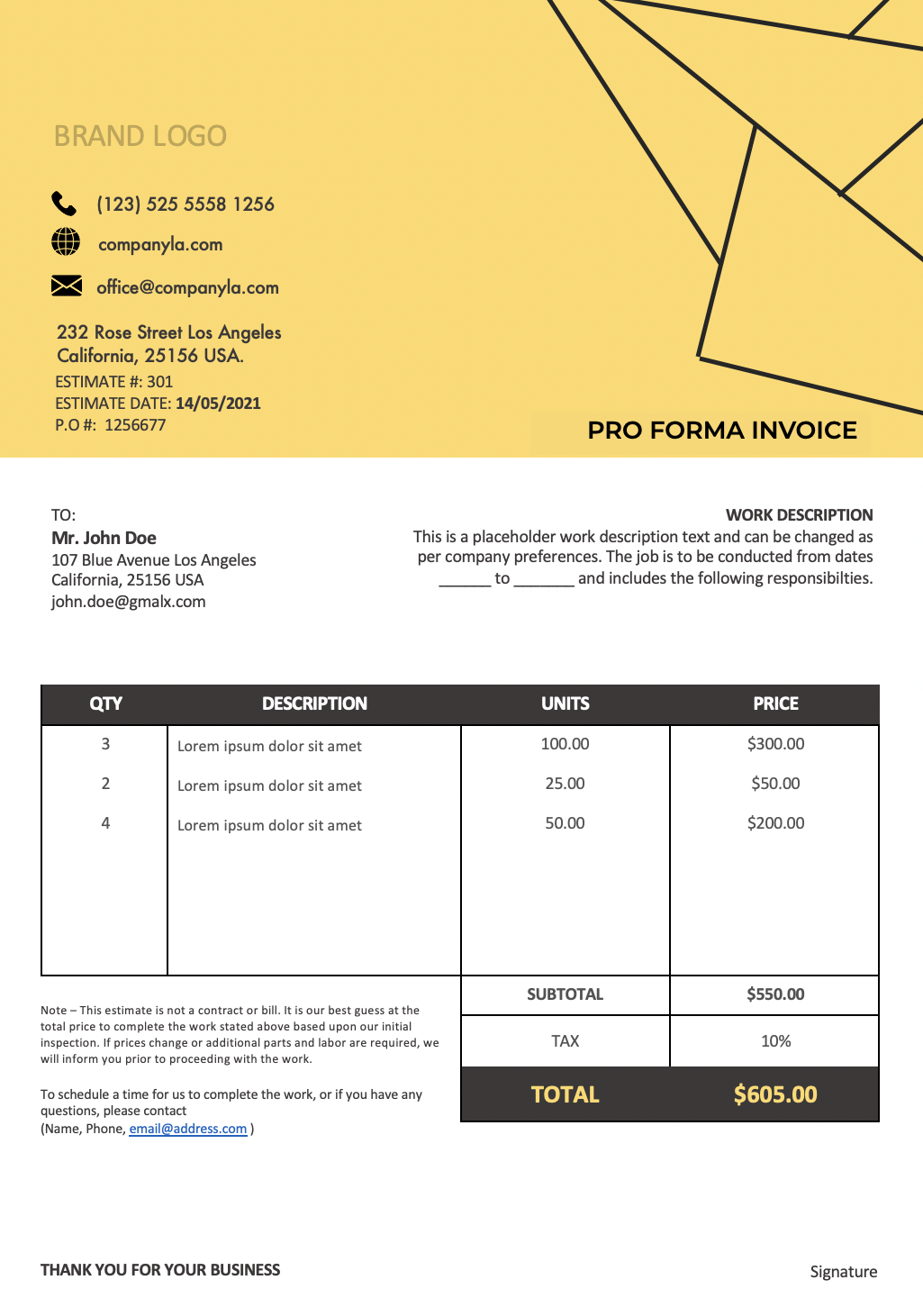

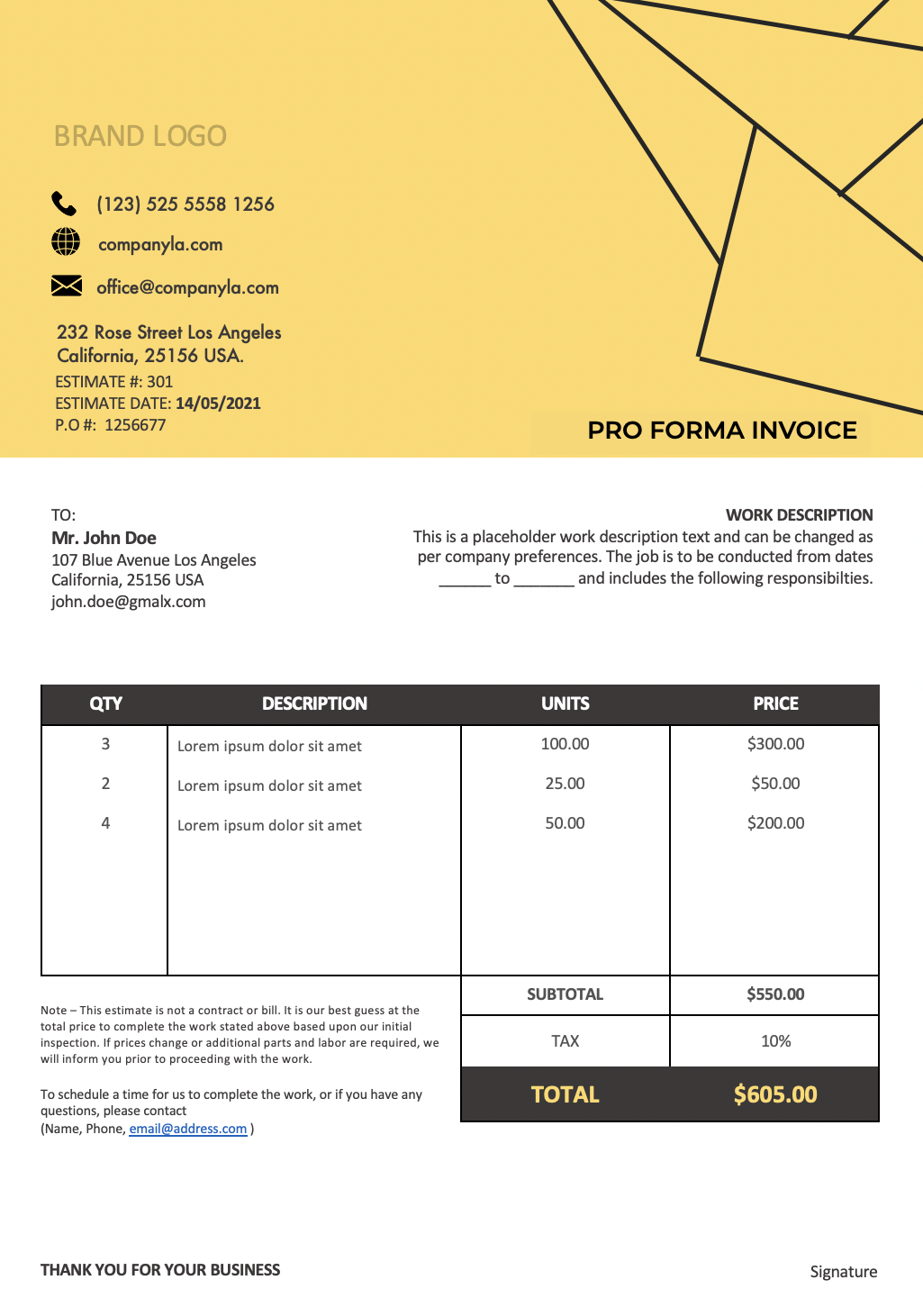

Proforma invoice templates

Download our package of professionally designed proforma invoice templates

Or try a free vcita acocunt and start to create unlimited estimates and invoices, accept online payments and more

Download our package of professionally designed proforma invoice templates

Or try a free vcita acocunt and start to create unlimited estimates and invoices, accept online payments and more

Pro forma is a Latin term that translates roughly as ‘for form.’ Proforma invoices are quotes or estimates that you send to a customer before you ship product or do any work. By providing this information up front, you and the customer know what to expect and misunderstandings are much less likely to occur.

Other benefits include:

Although they aren’t legally binding, proforma invoices are an informal sign of commitment between you and your customer, leaving you more confident about the sale.

If you sell to the government, there is typically a detailed approval process. A proforma invoice provides the client with all the details they need to get the final sale approved.

Many businesses use proforma invoices with trusted overseas customers because the document provides all the details needed for the shipment to clear customs. After the shipment has been received, they send the customer a regular invoice.

Selling on consignment is always challenging because you can only invoice for items after they sell. With a proforma invoice, you can provide the customer with information about all the items shipped and then send a regular invoice once the items have sold.

What are the differences between actual invoices and proforma invoices?

What differentiate a proforma invoice from an estimate?

What is the difference between a proforma invoice vs. purchase order?

What is the difference between a tax invoice and a proforma invoice?

Is the proforma invoice binding upon the parties in a supply transaction?

Can a client negotiate price and other details in a proforma invoice?

Copyright 2026 vcita Inc. All rights reserved.

vcita, 200 Central Ave, St. Petersburg, FL 33701