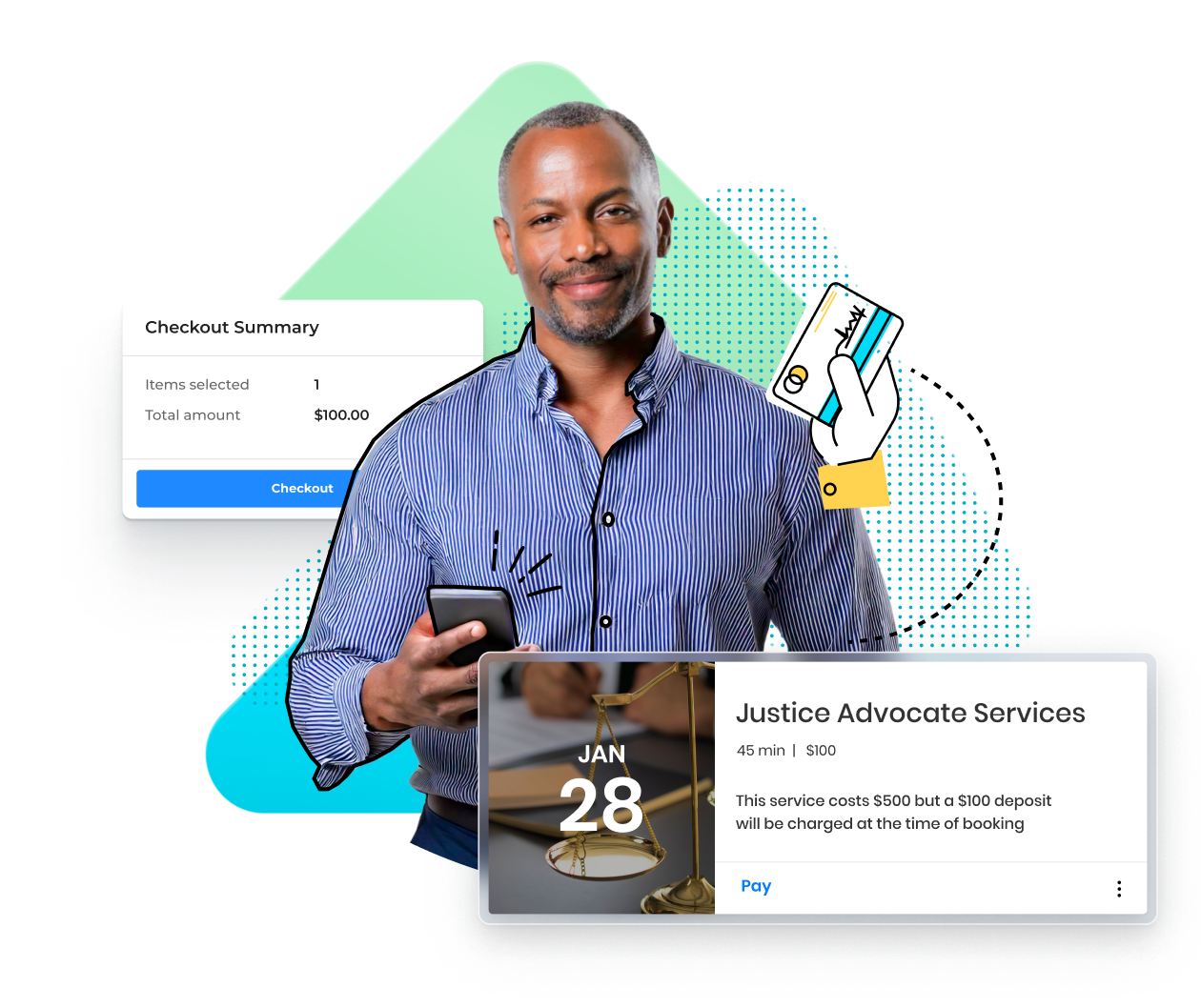

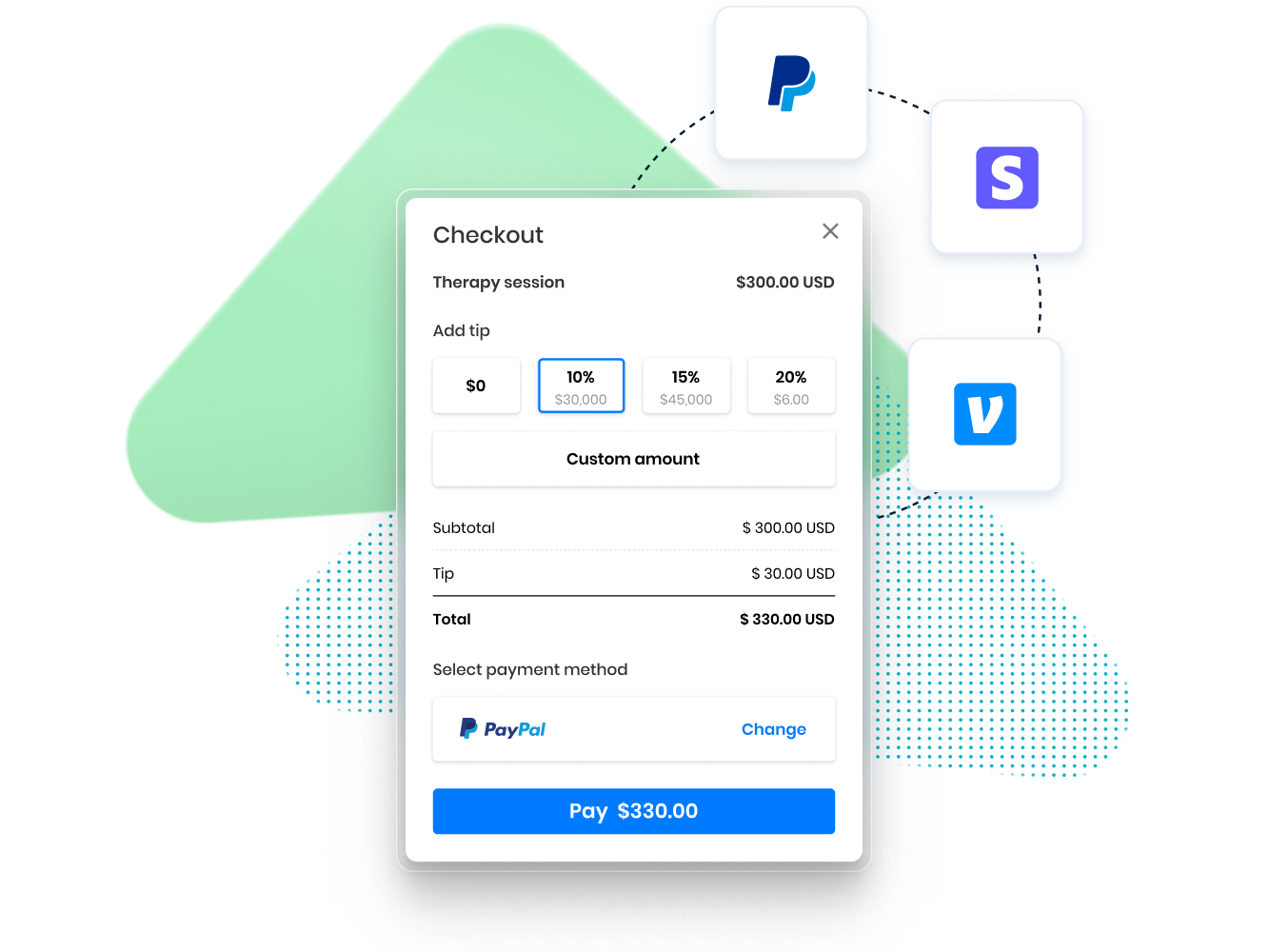

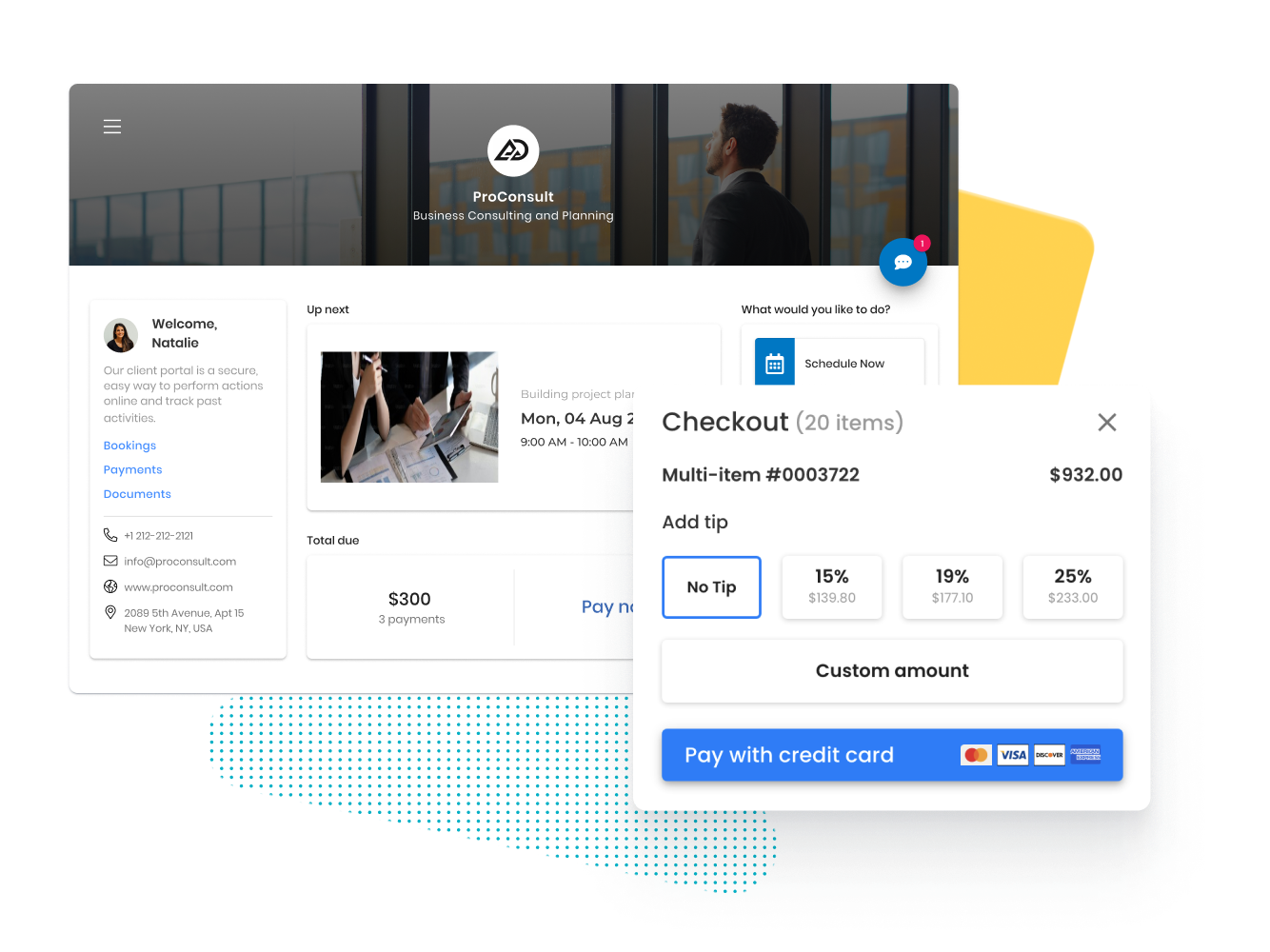

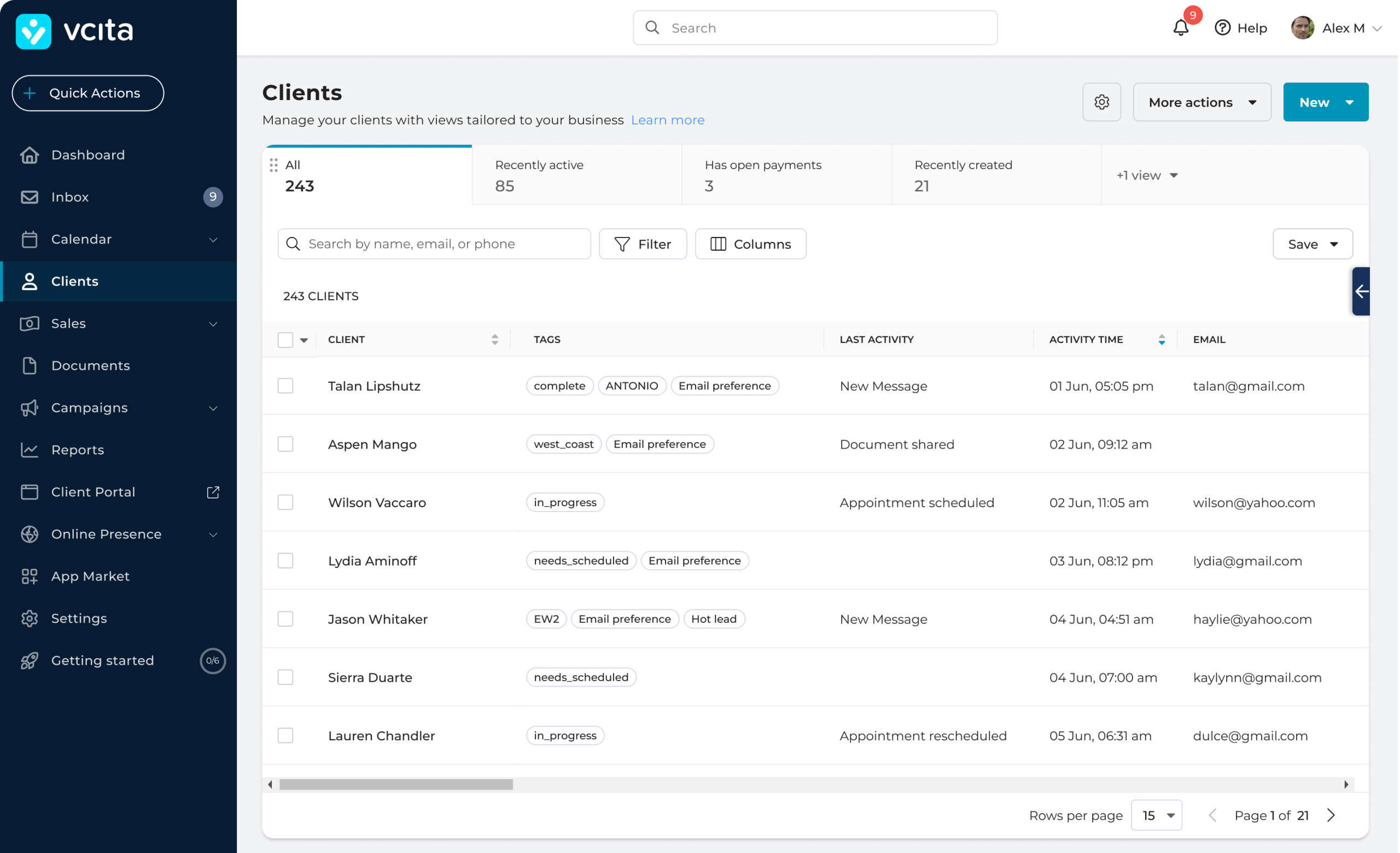

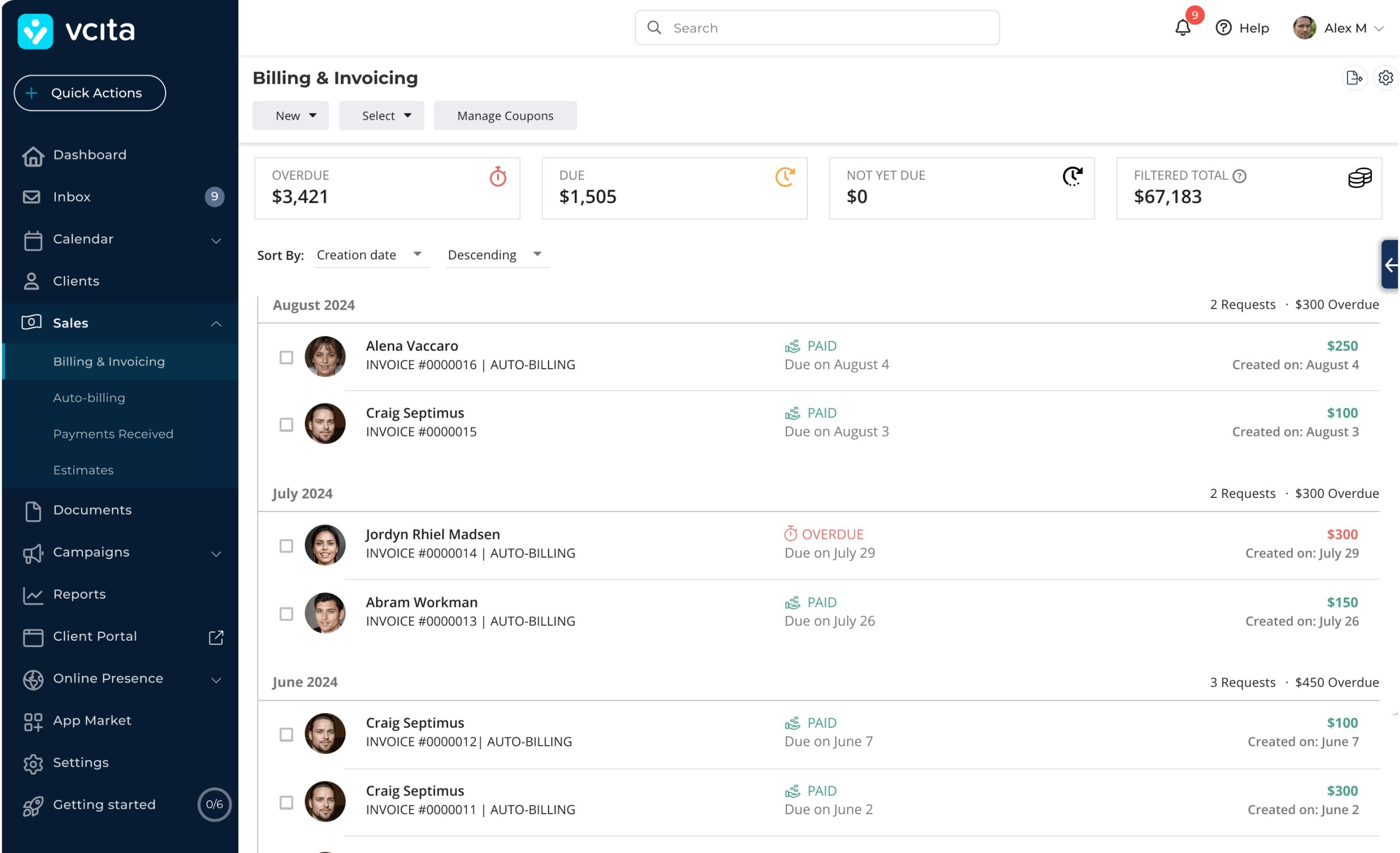

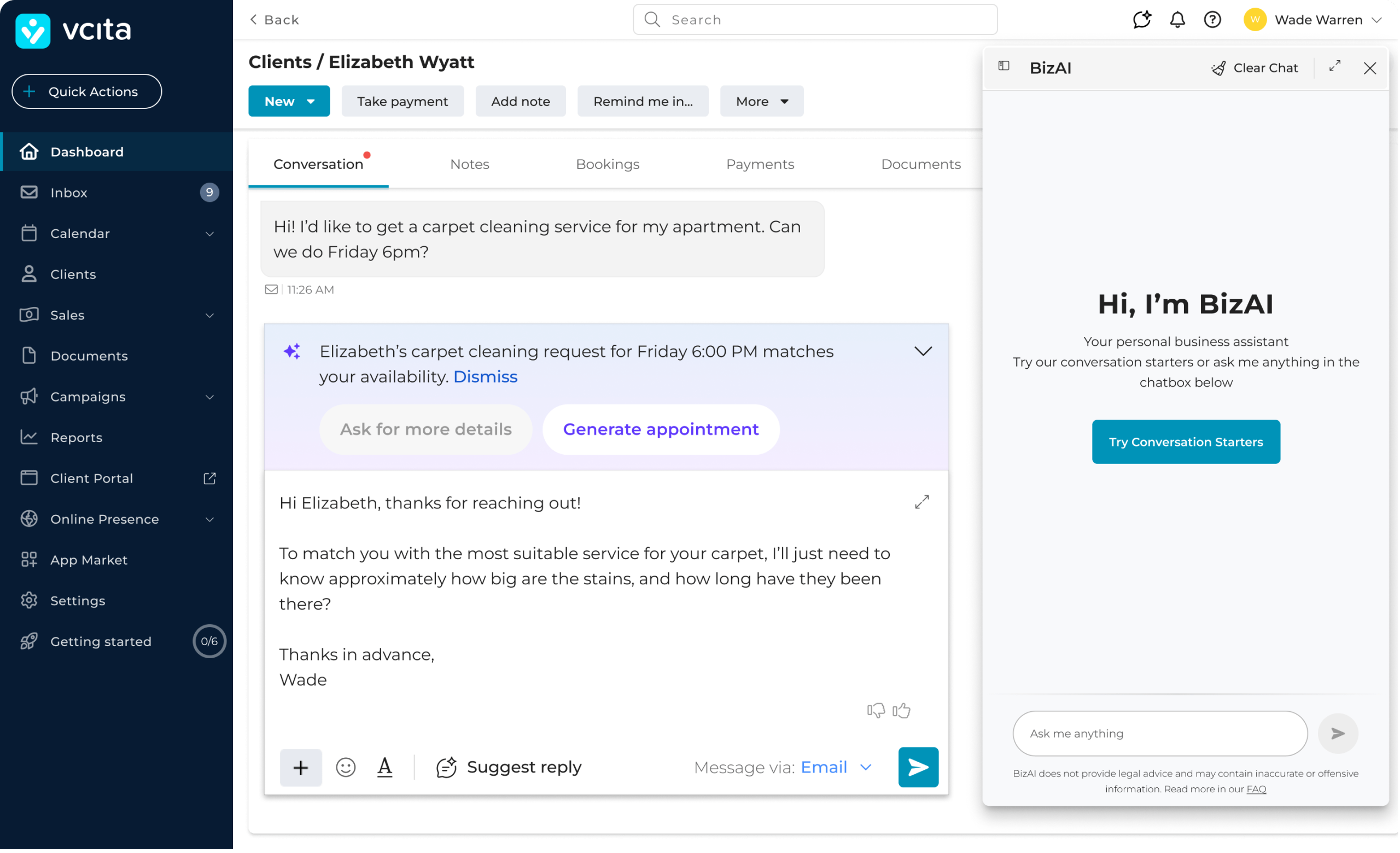

ONLINE CREDIT CARD PROCESSING

Process credit cards online. Simple and easy.

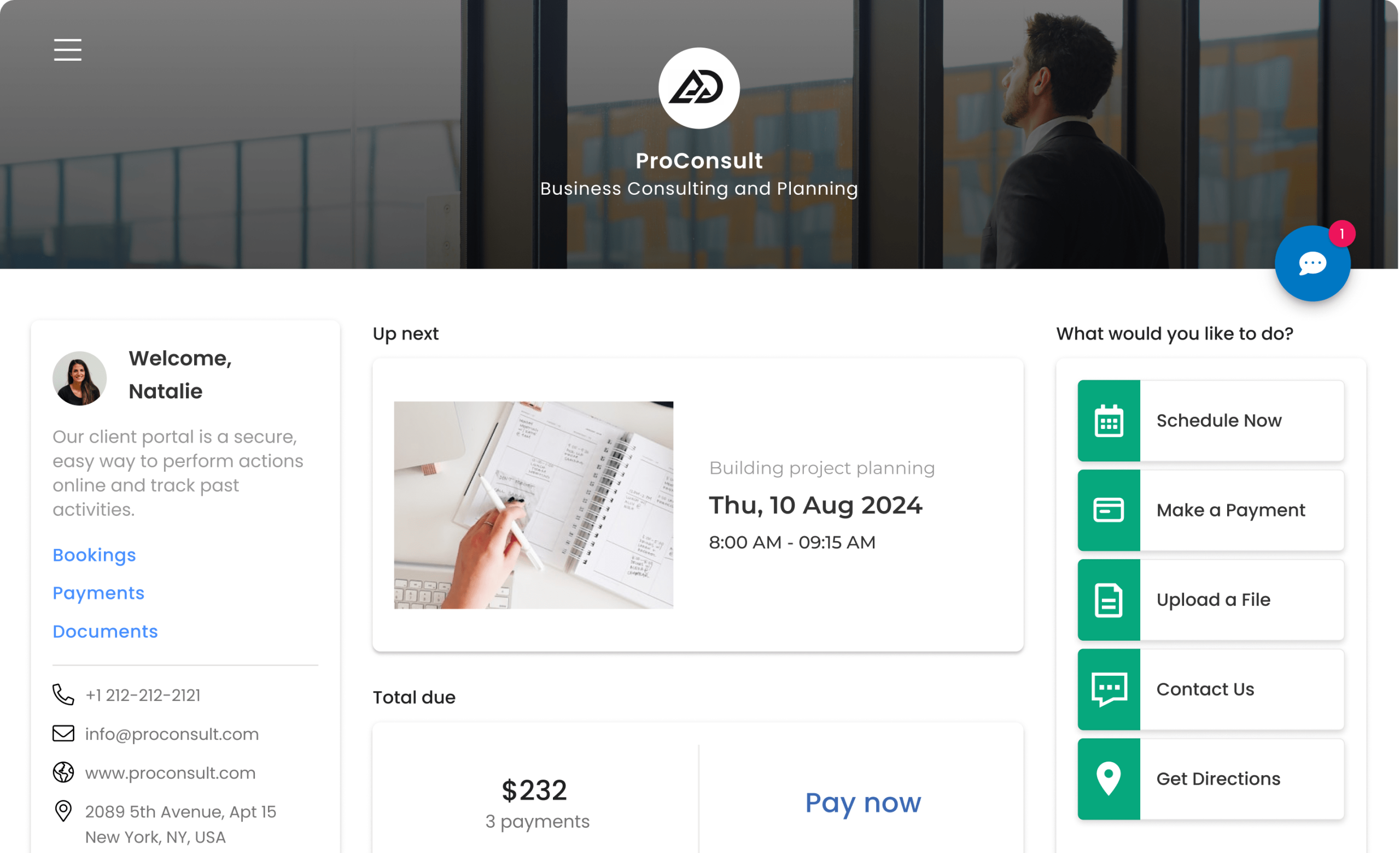

Accept credit card payments effortlessly with vcita’s online credit card processing tailored specifically for small businesses. Our secure payment collection solutions make the flow smooth and efficient, ensuring you get paid quickly and easily.

No credit card required