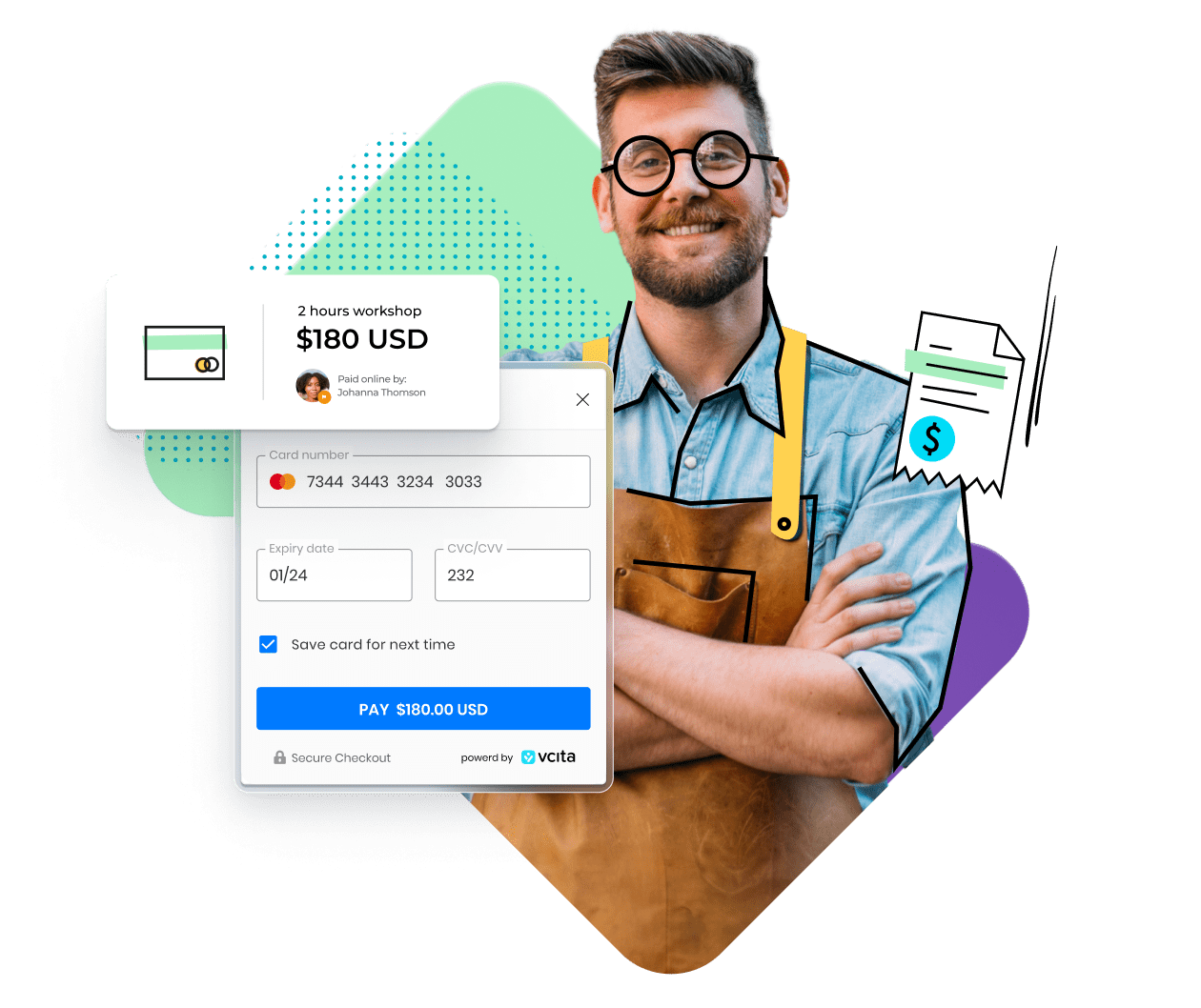

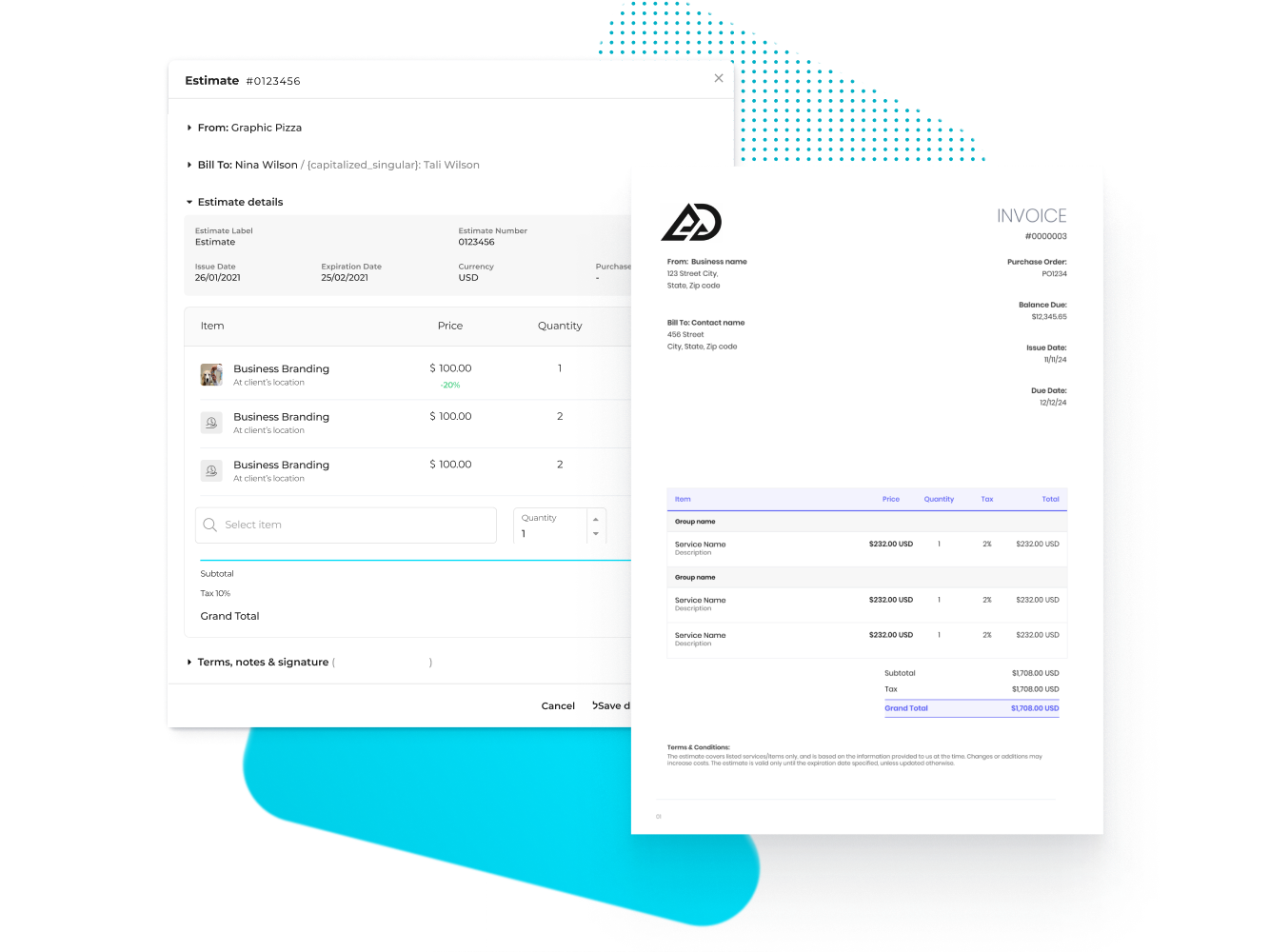

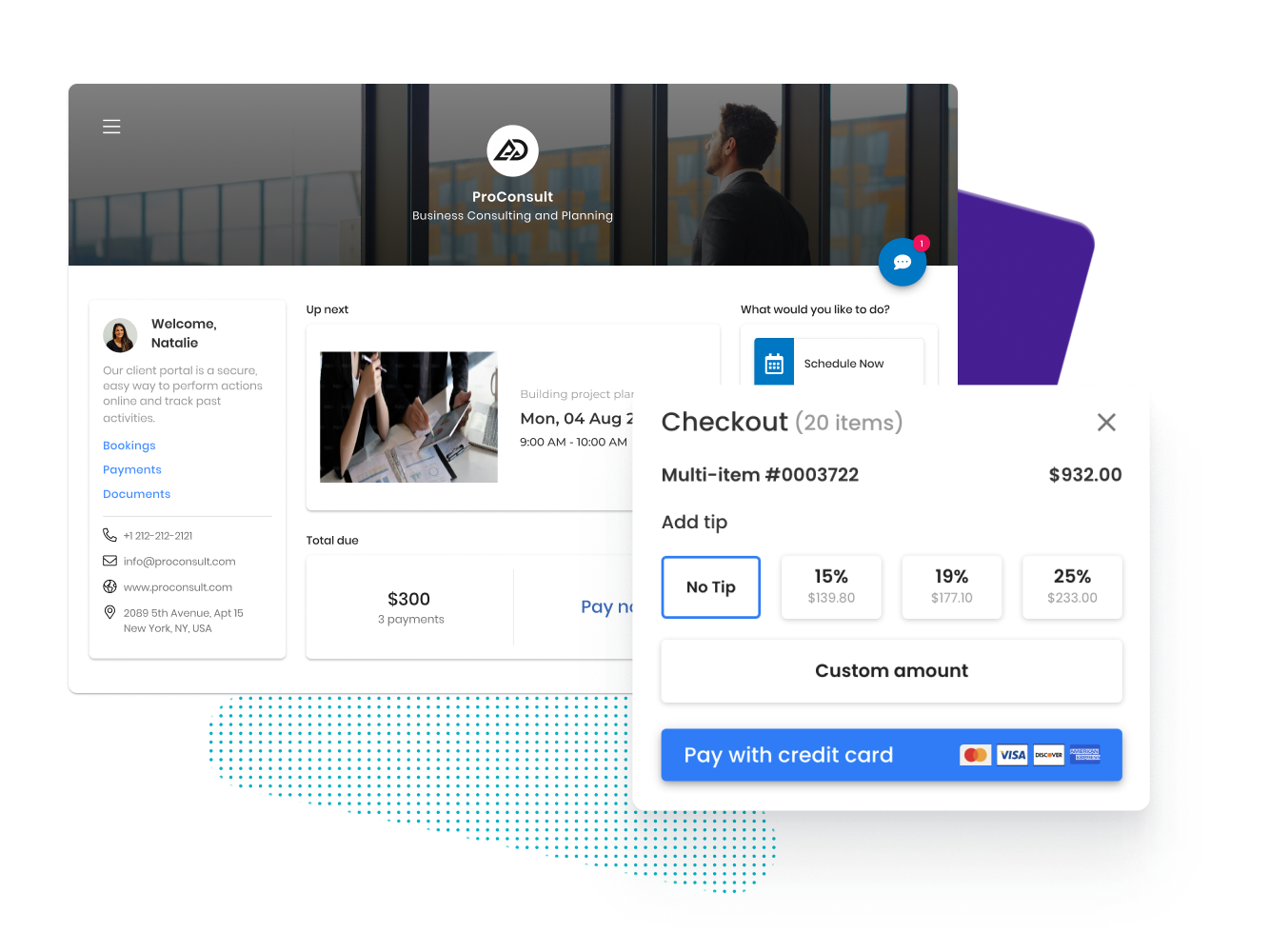

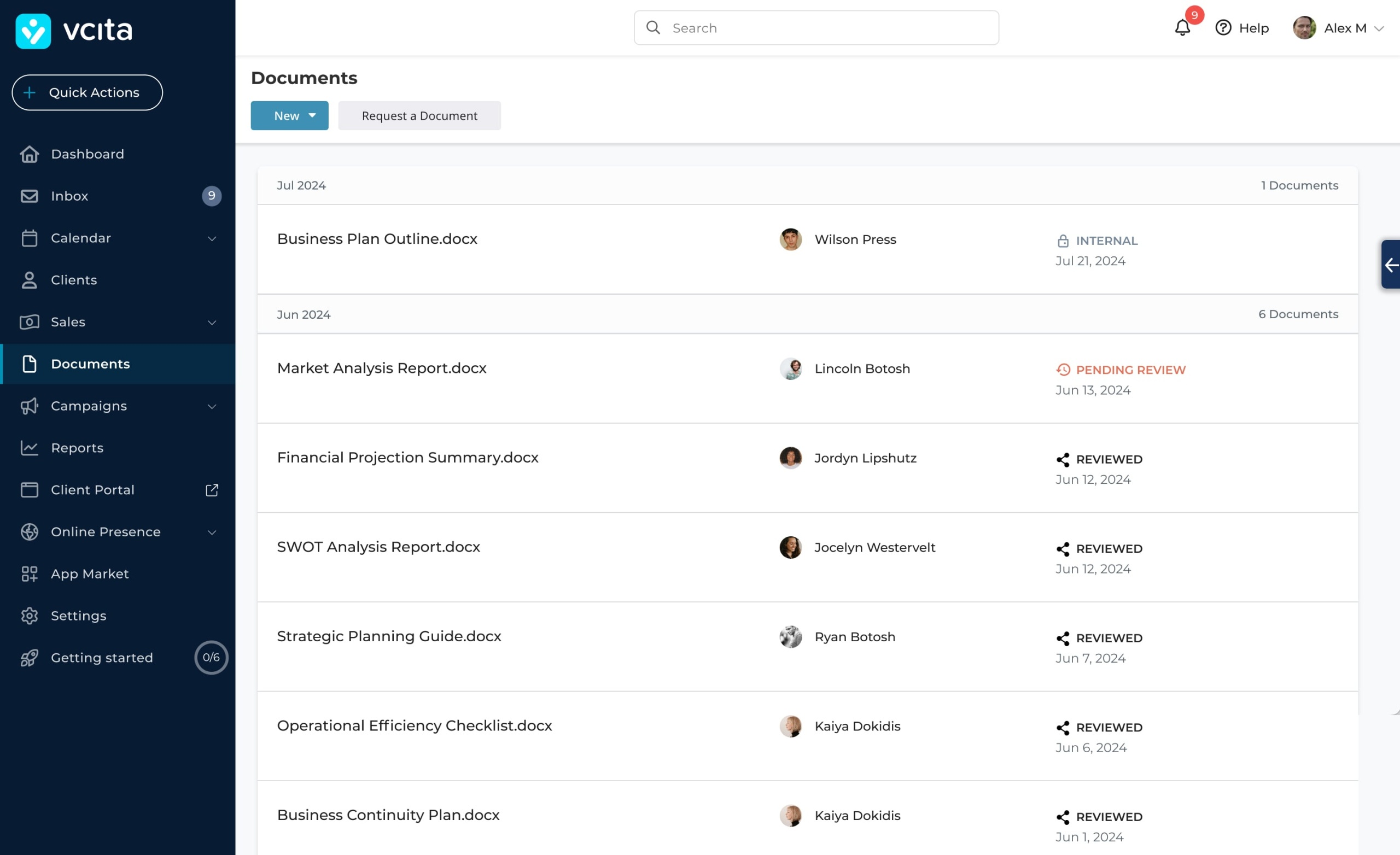

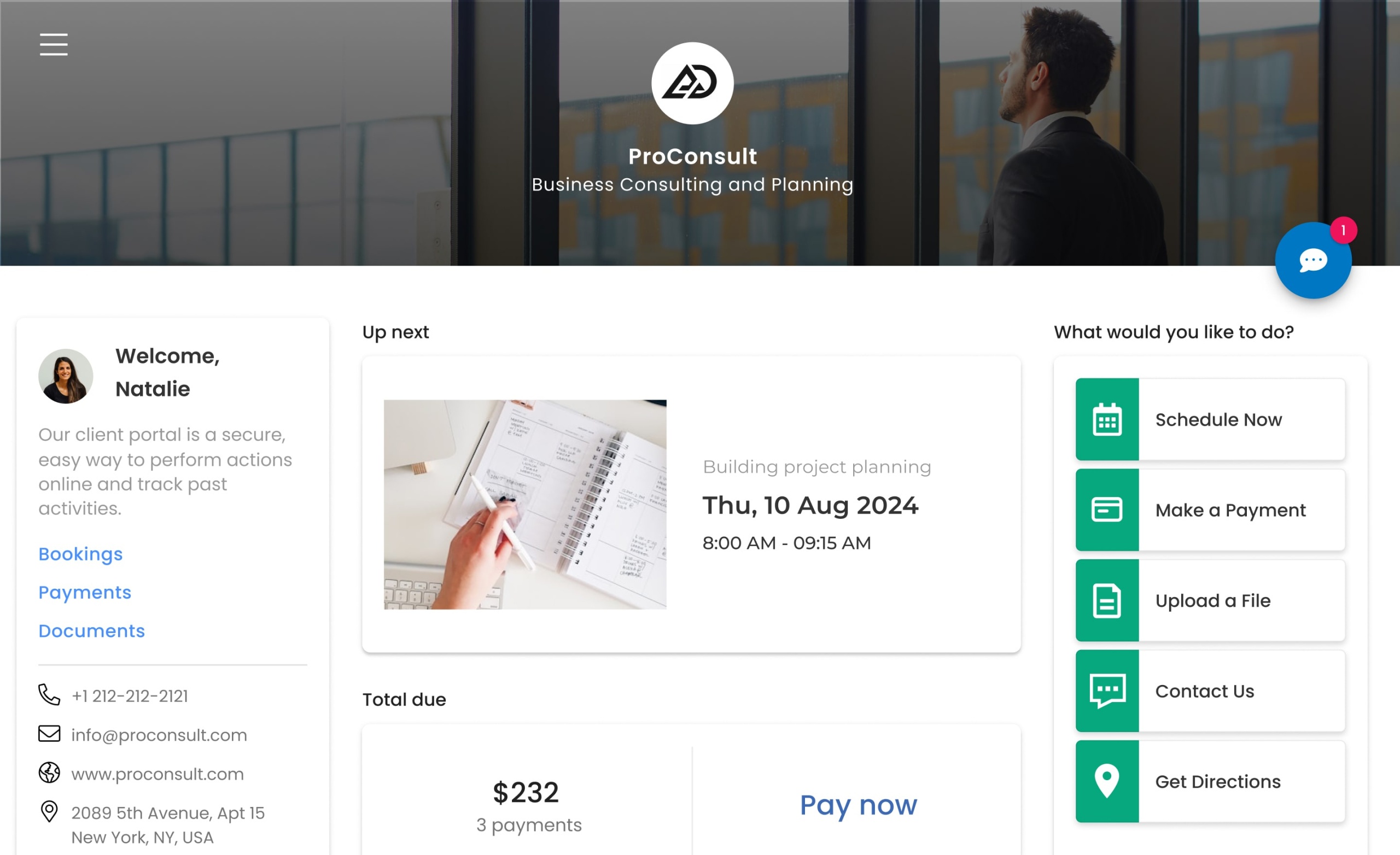

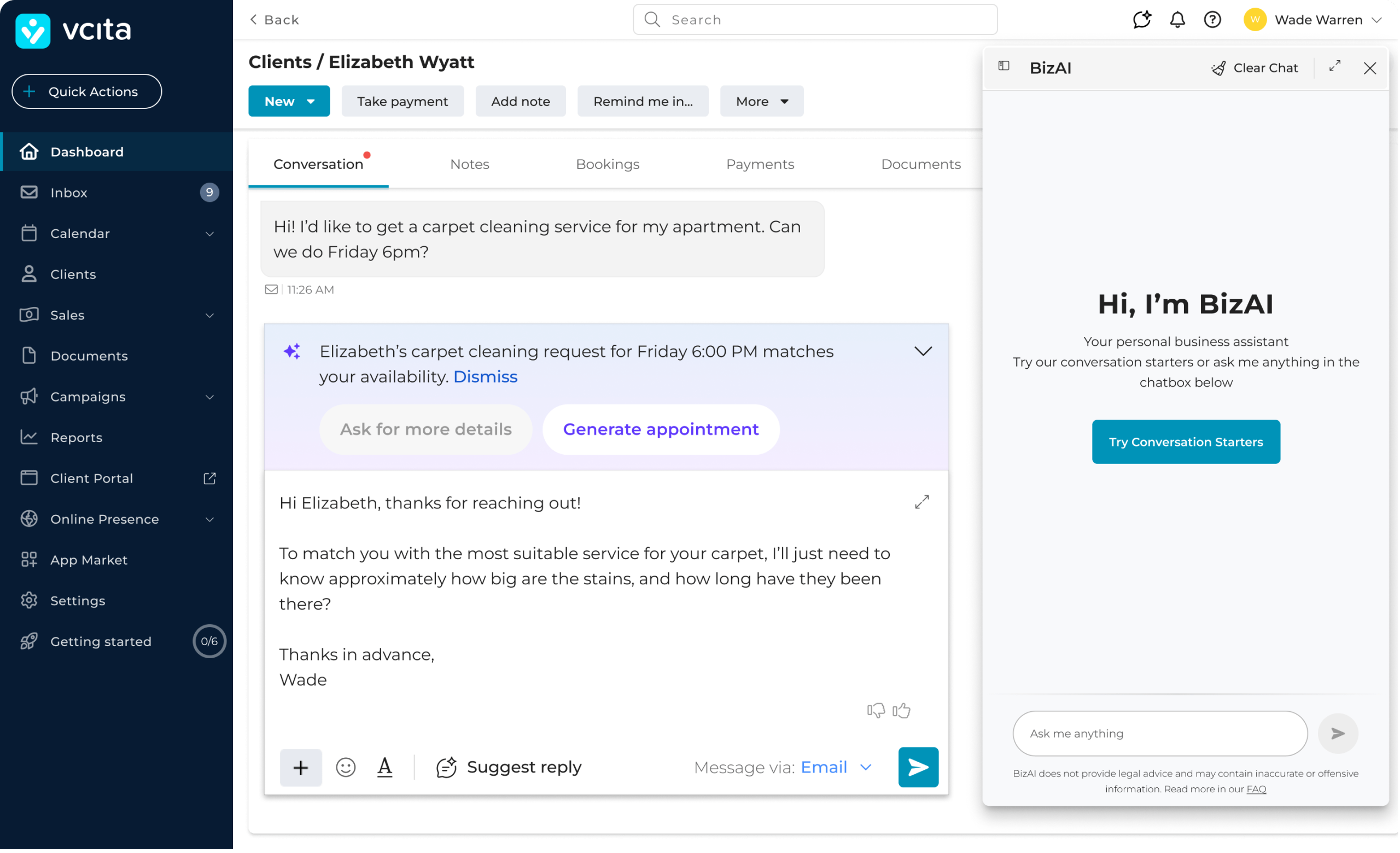

INVOICING SOFTWARE

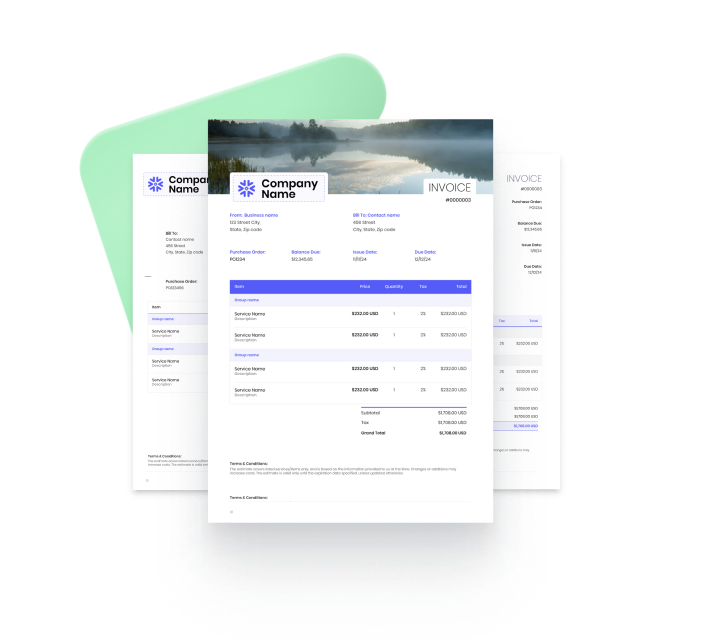

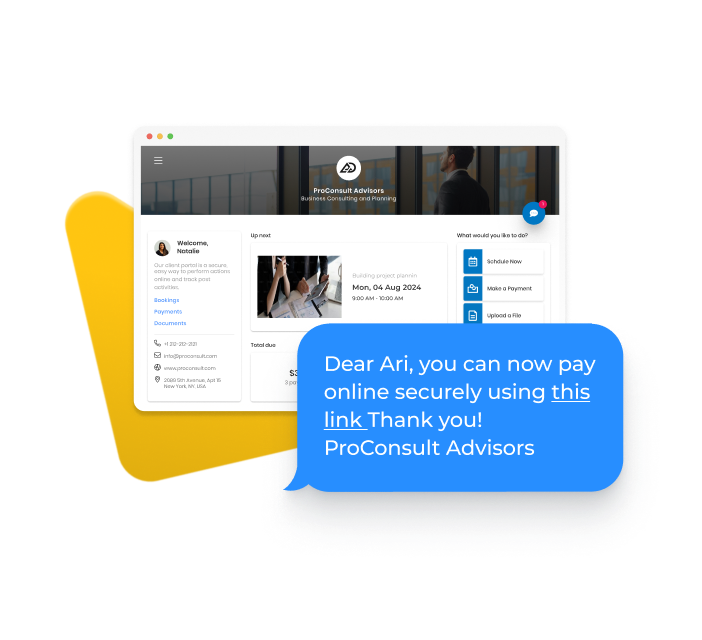

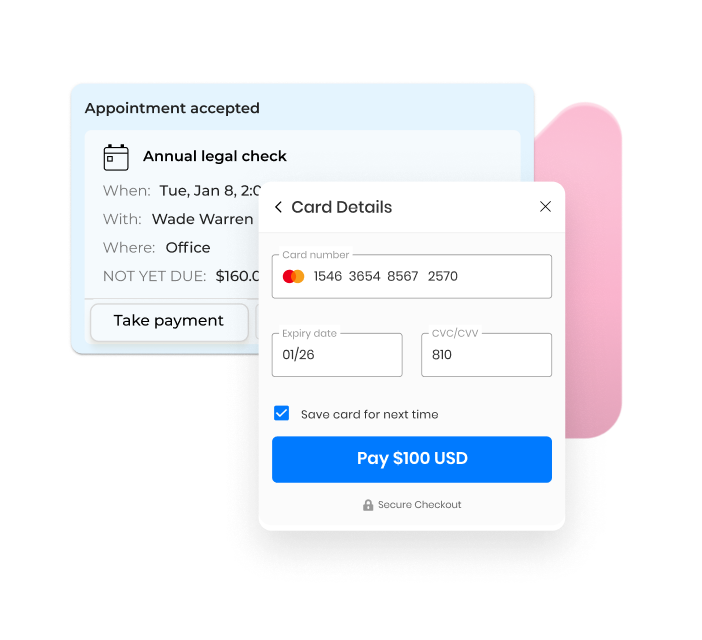

Get paid fast and easy, with professional invoices.

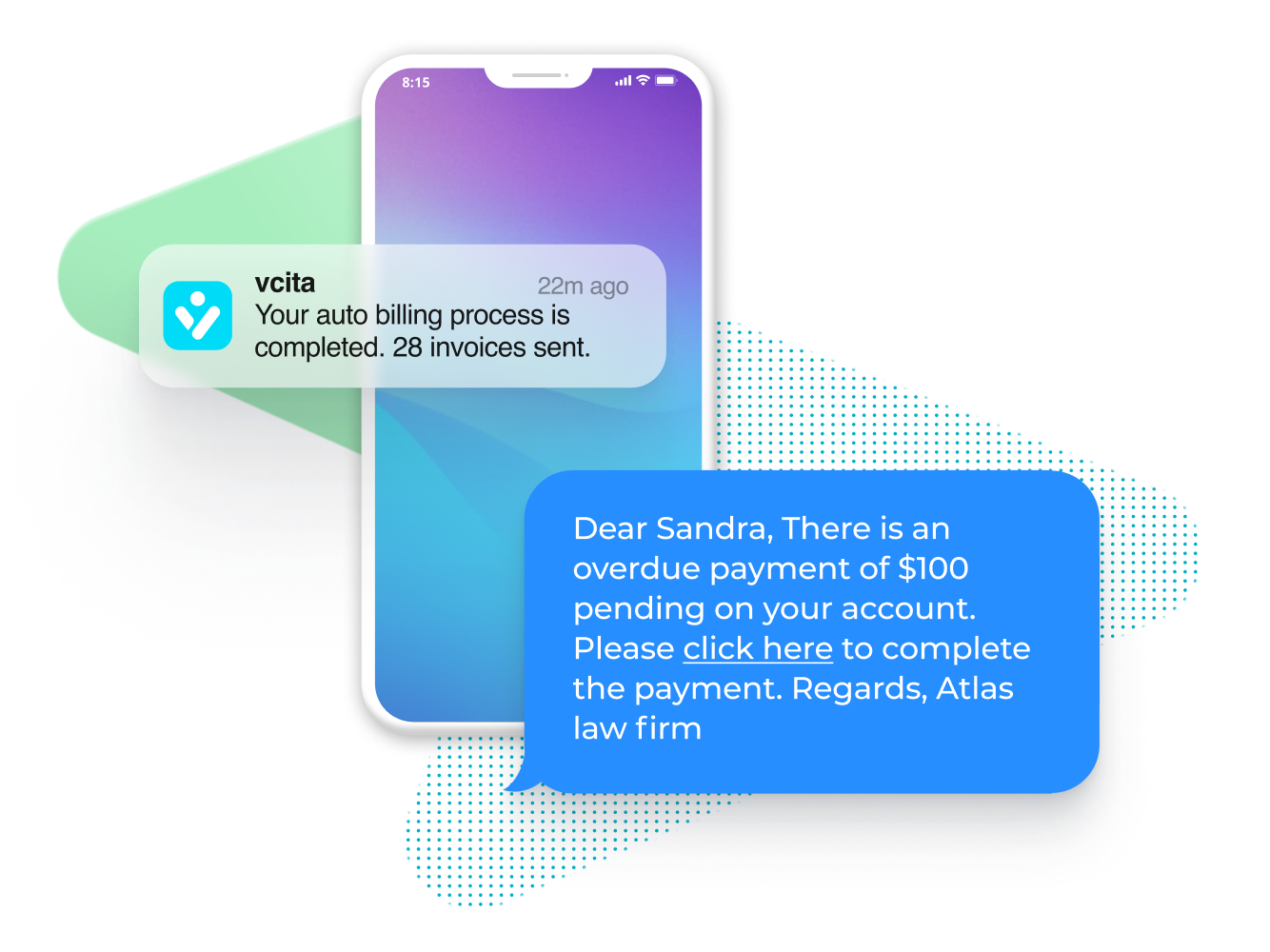

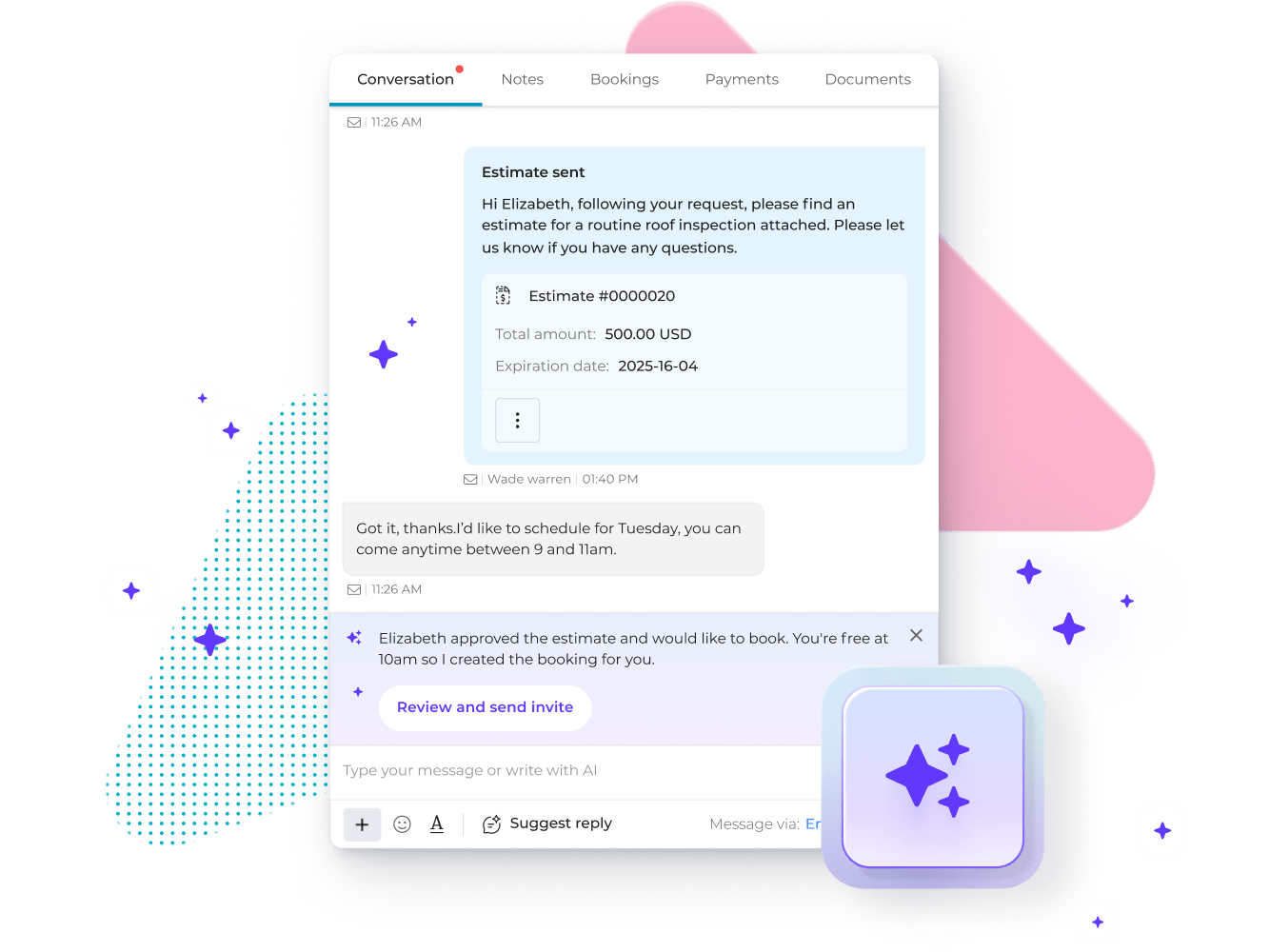

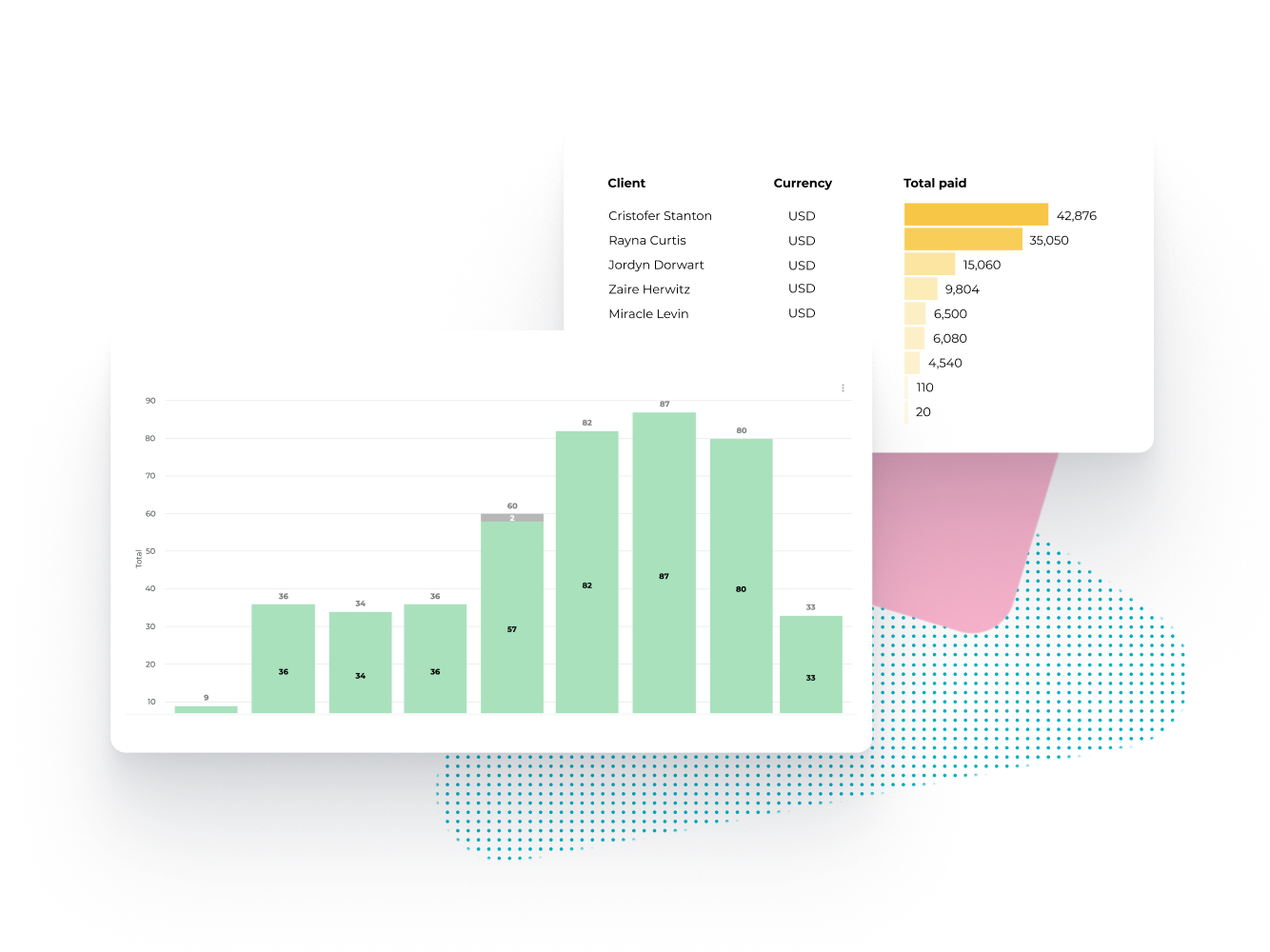

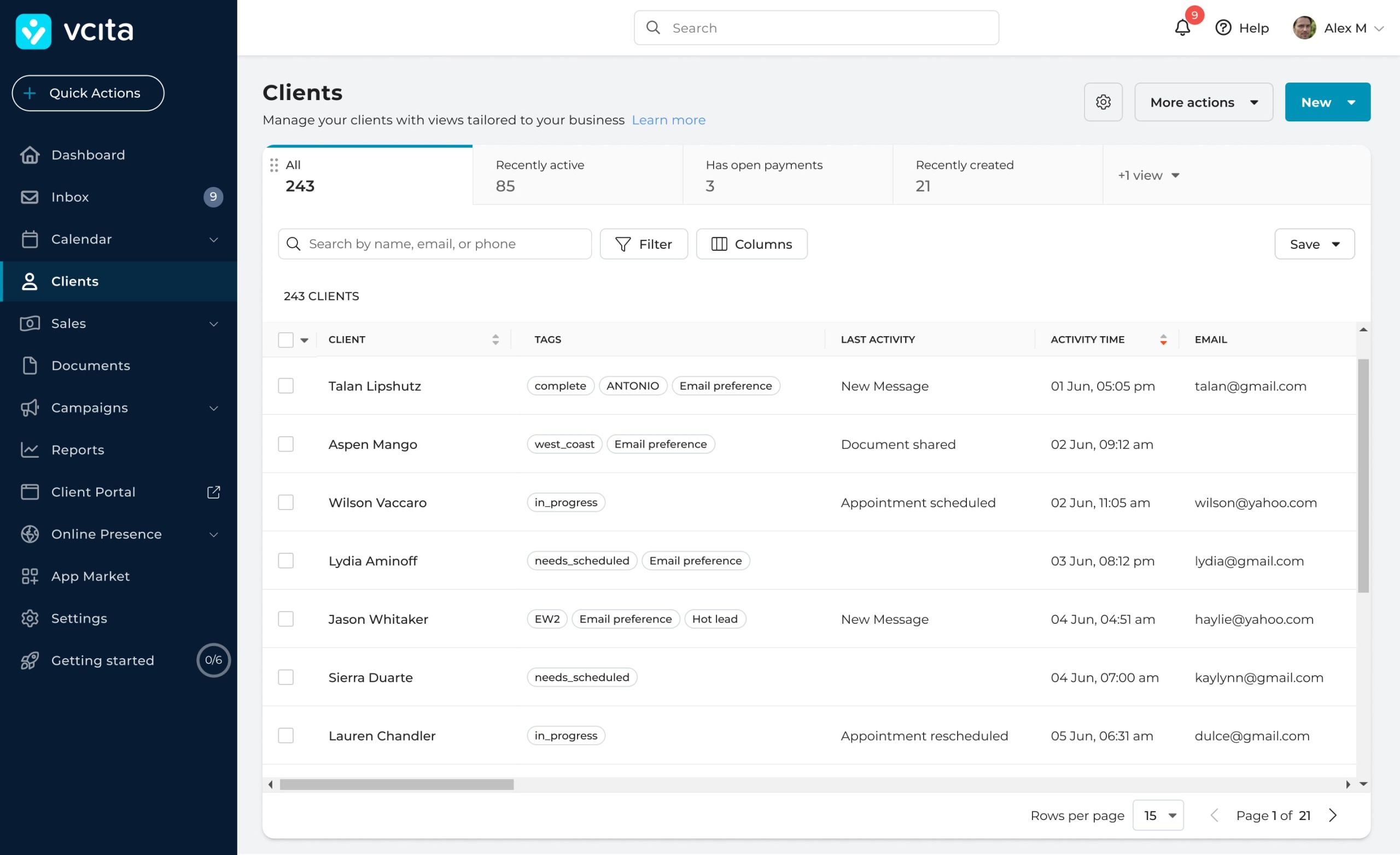

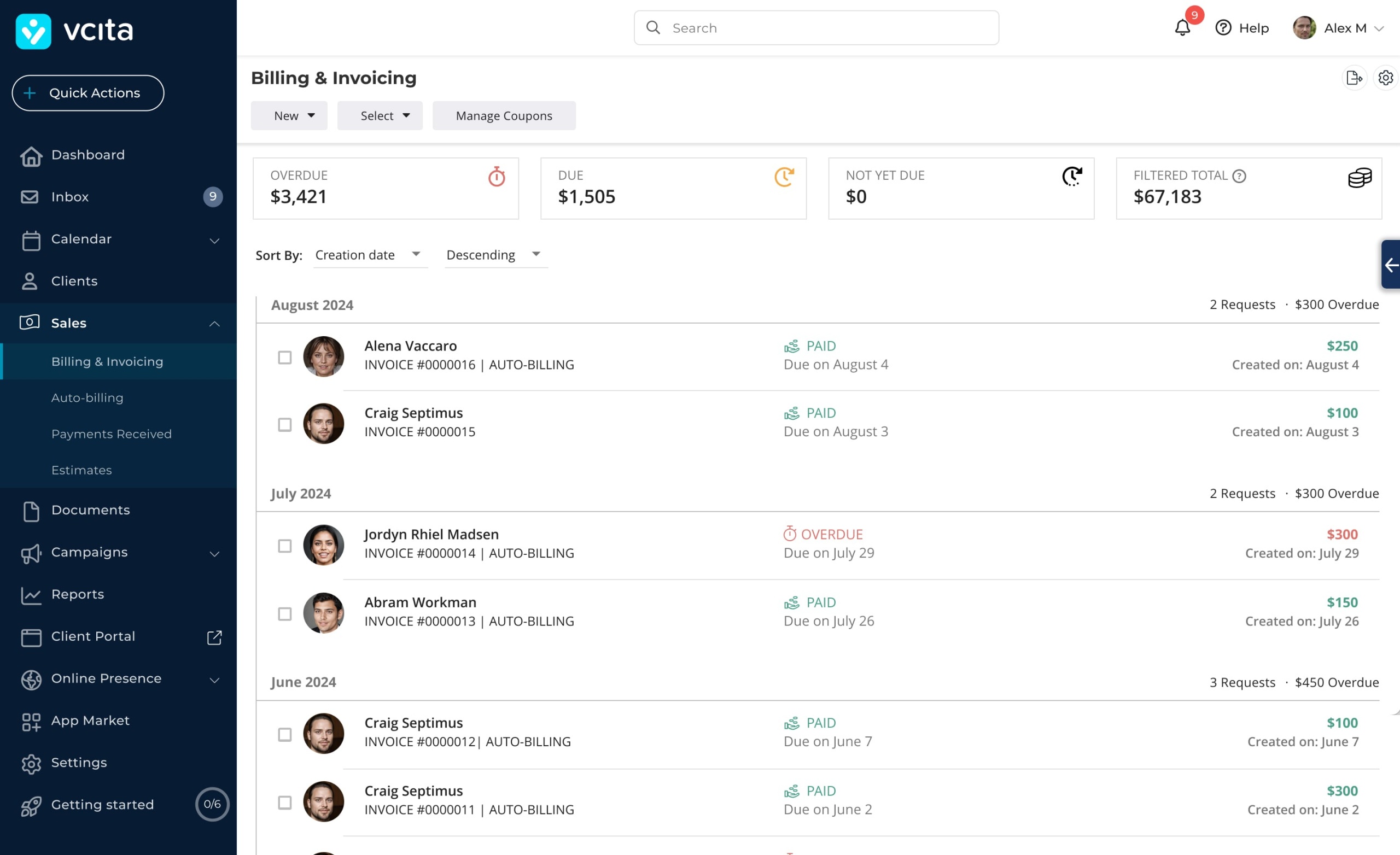

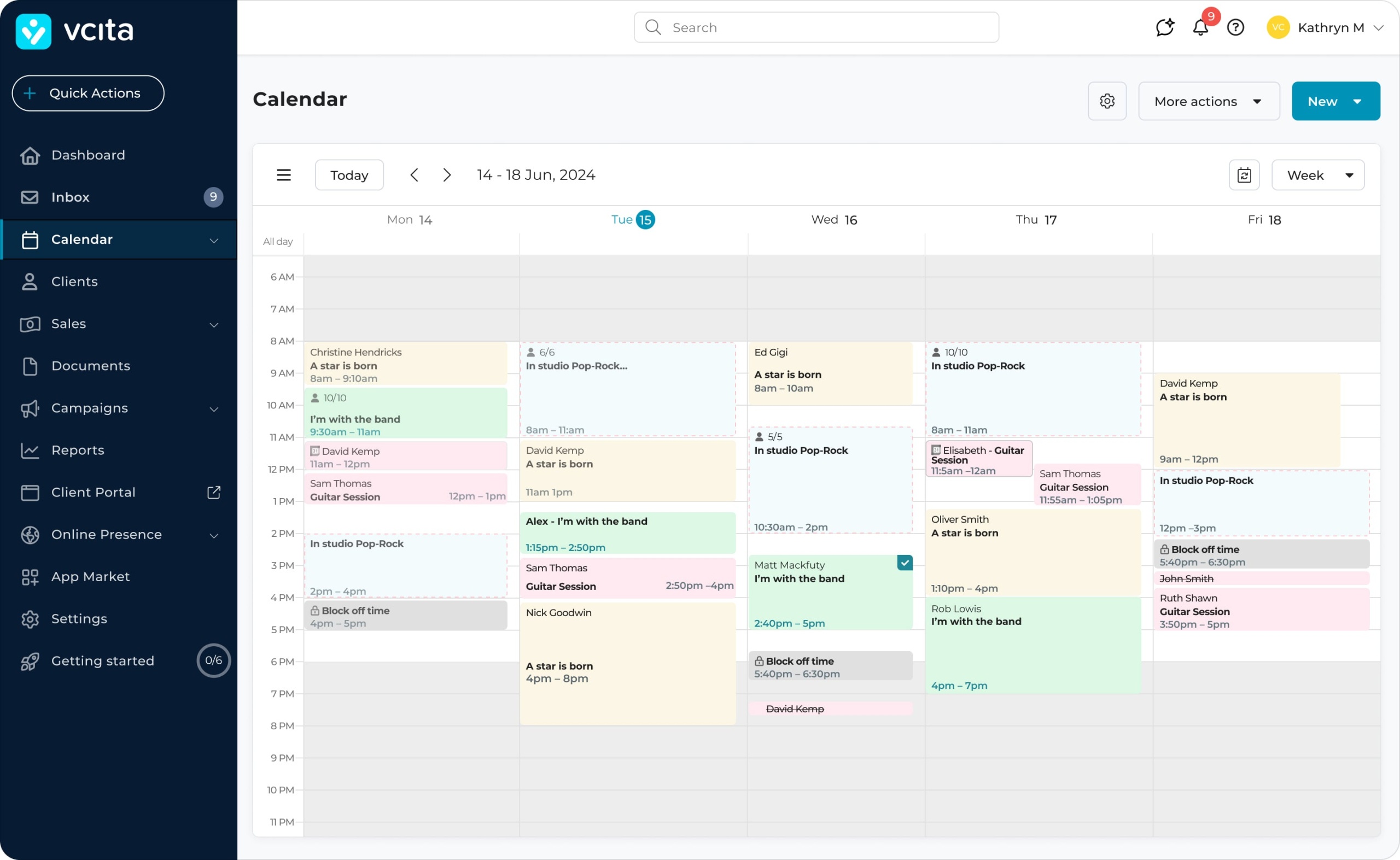

Manage your entire billing in one place: from estimates, online invoicing, billing automation, and payment reminders. vcita’s invoicing solution simplifies payment collection and gets your money in the bank fast.

No credit card required