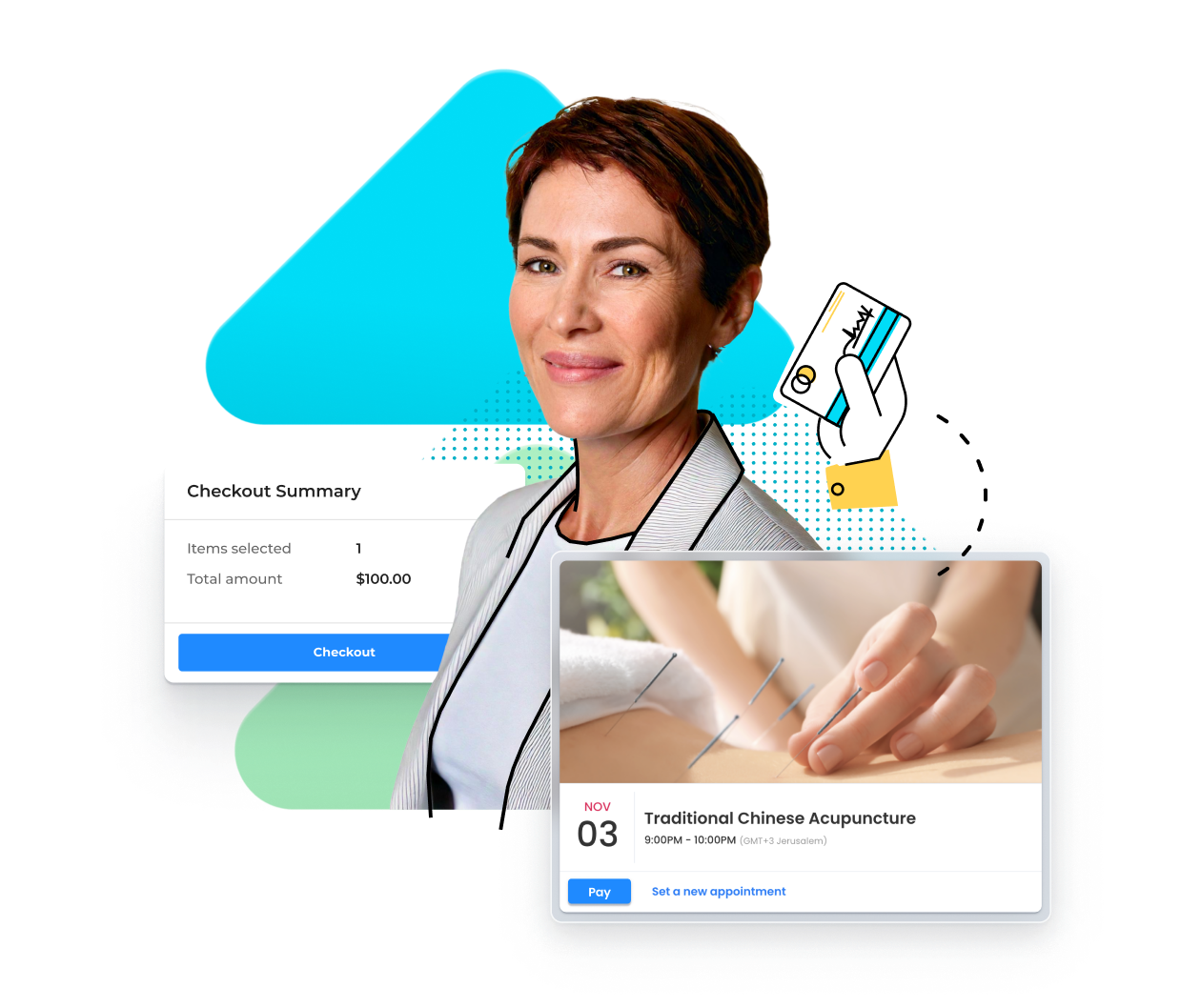

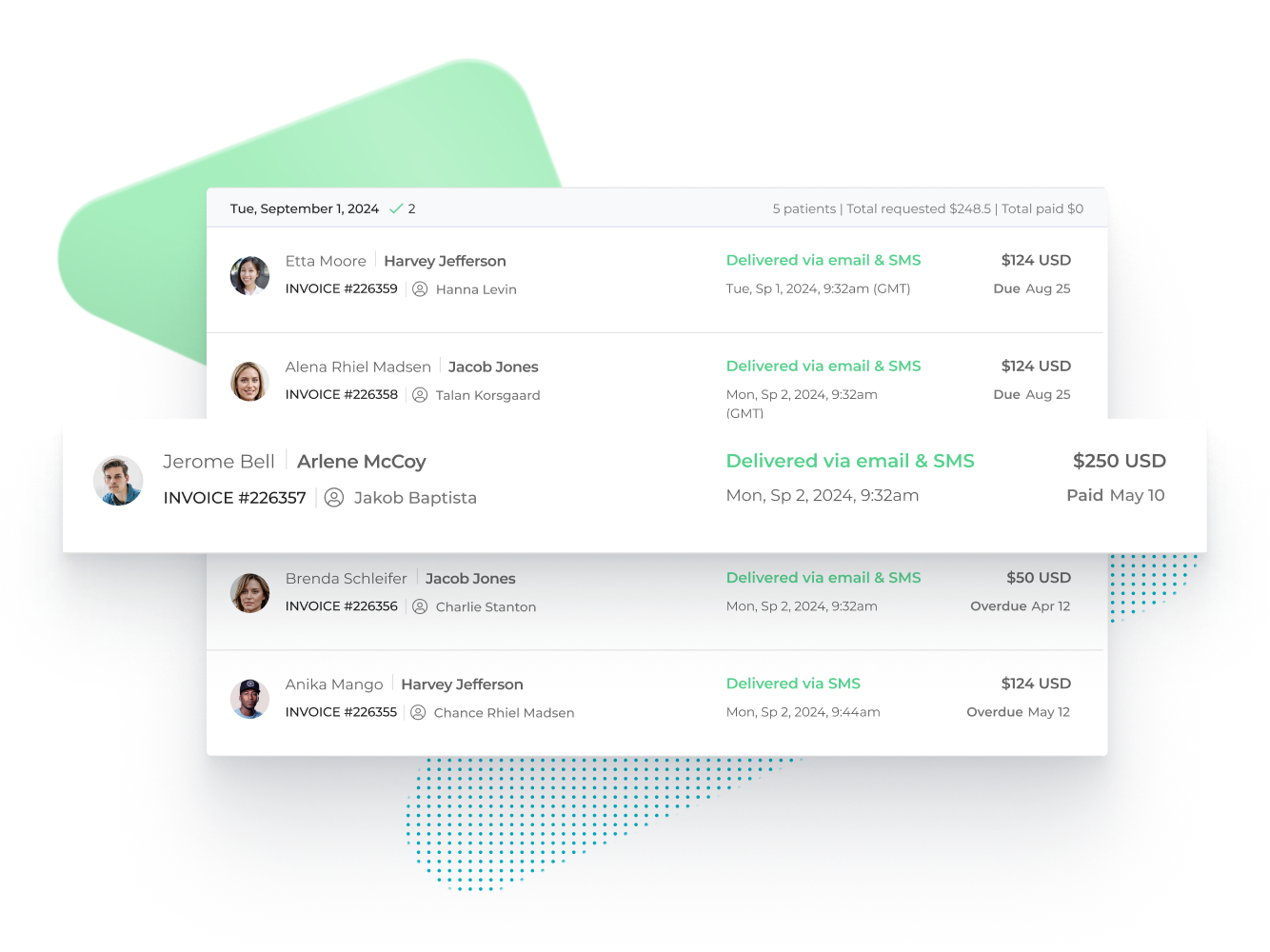

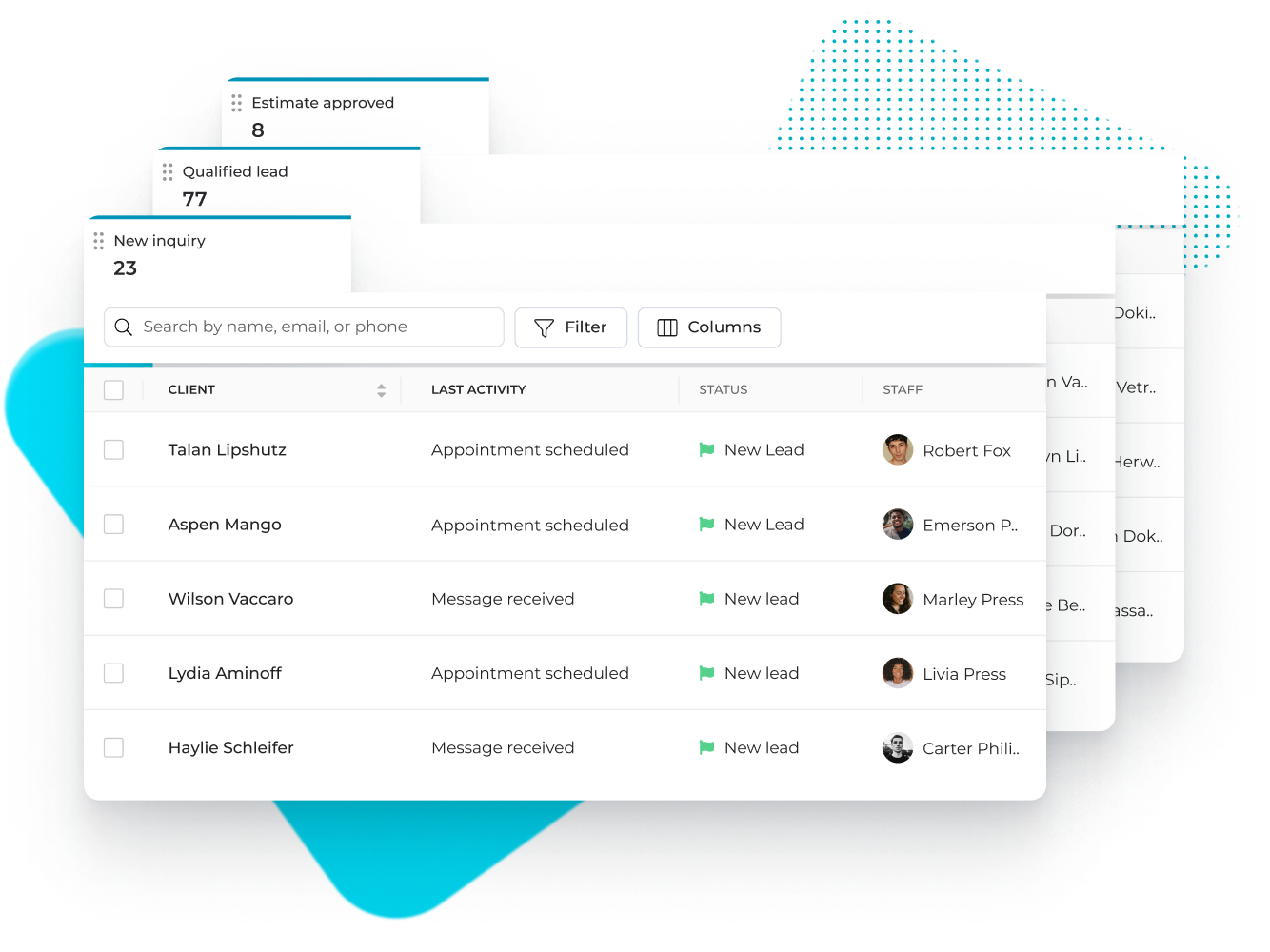

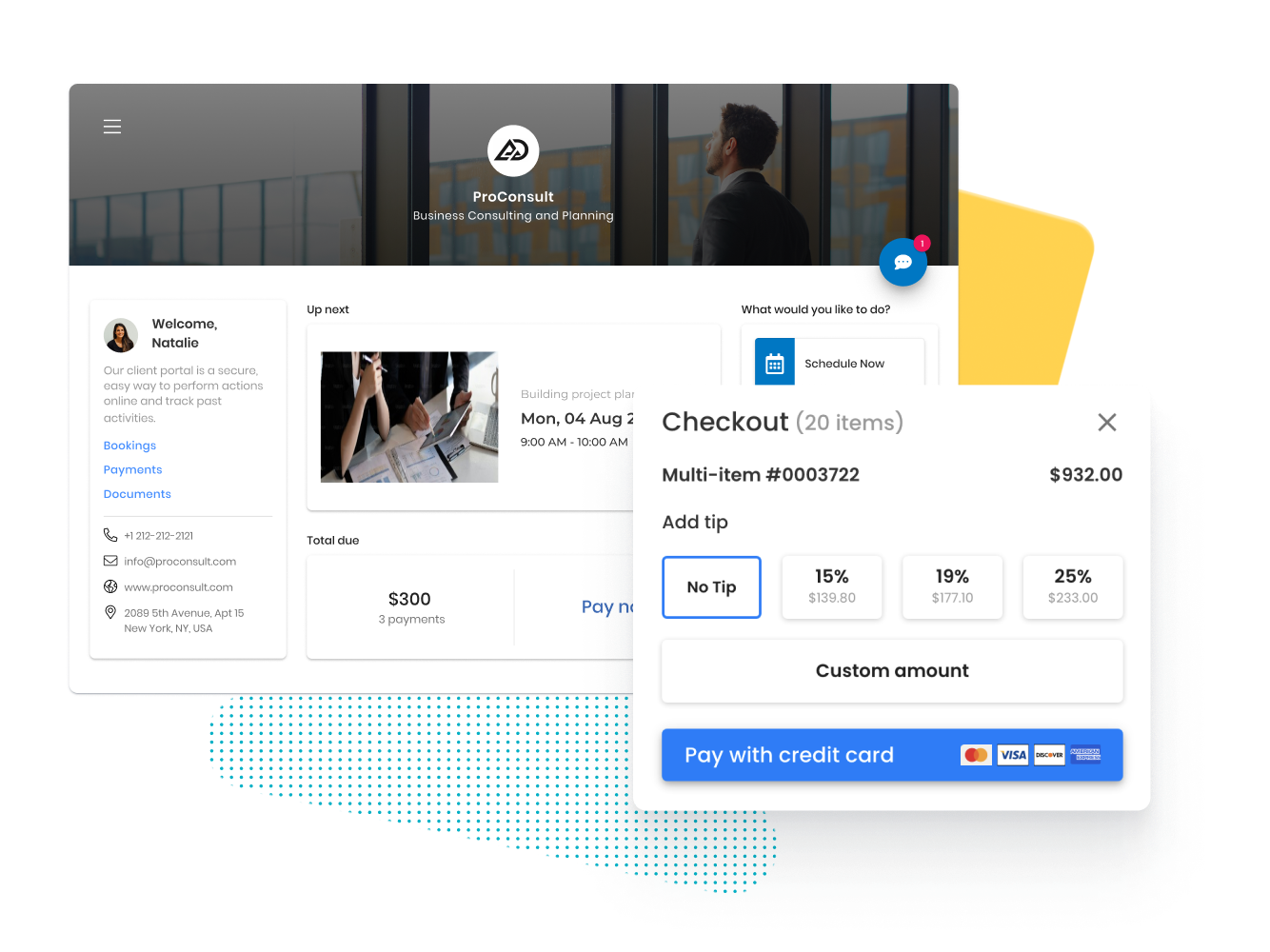

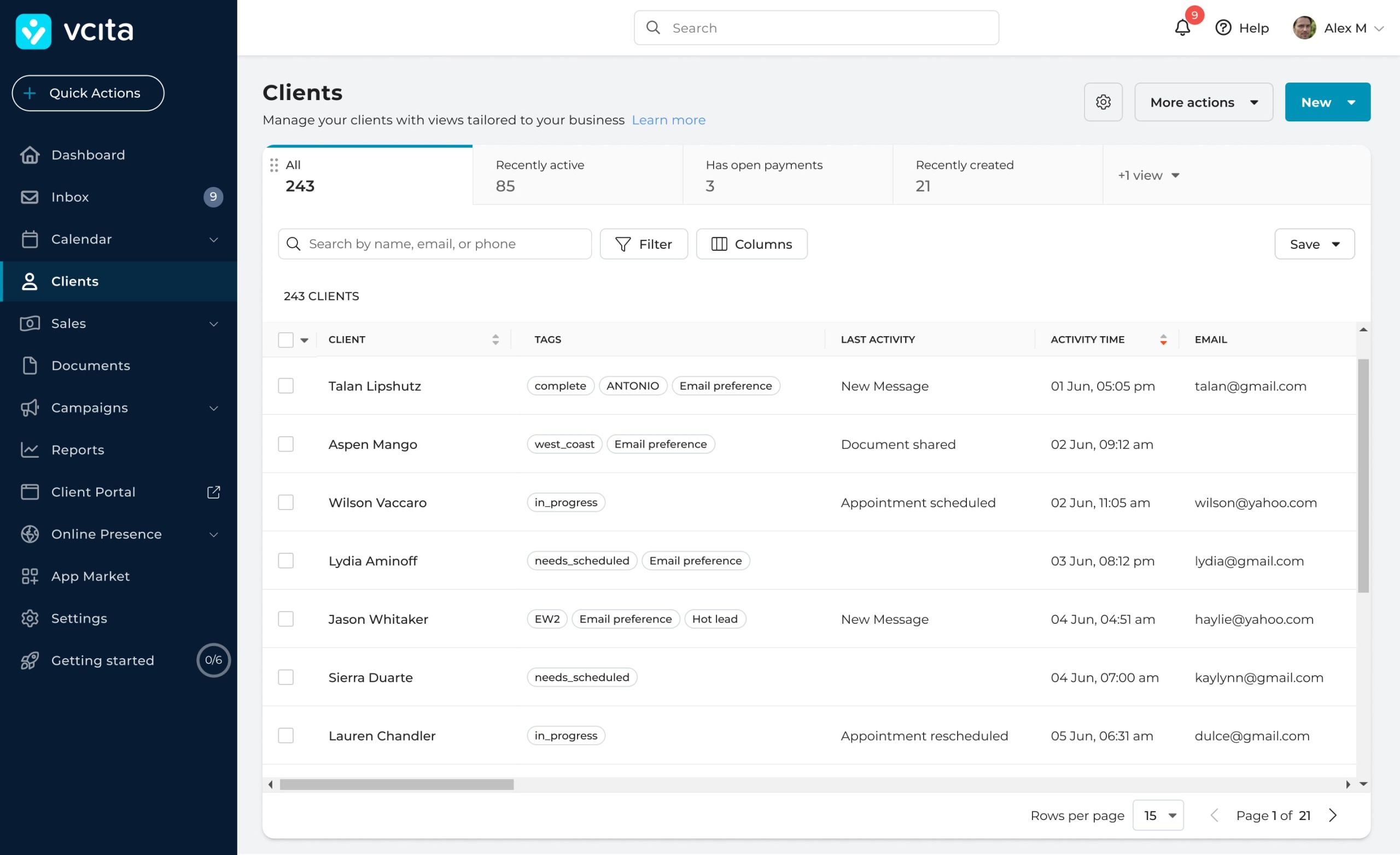

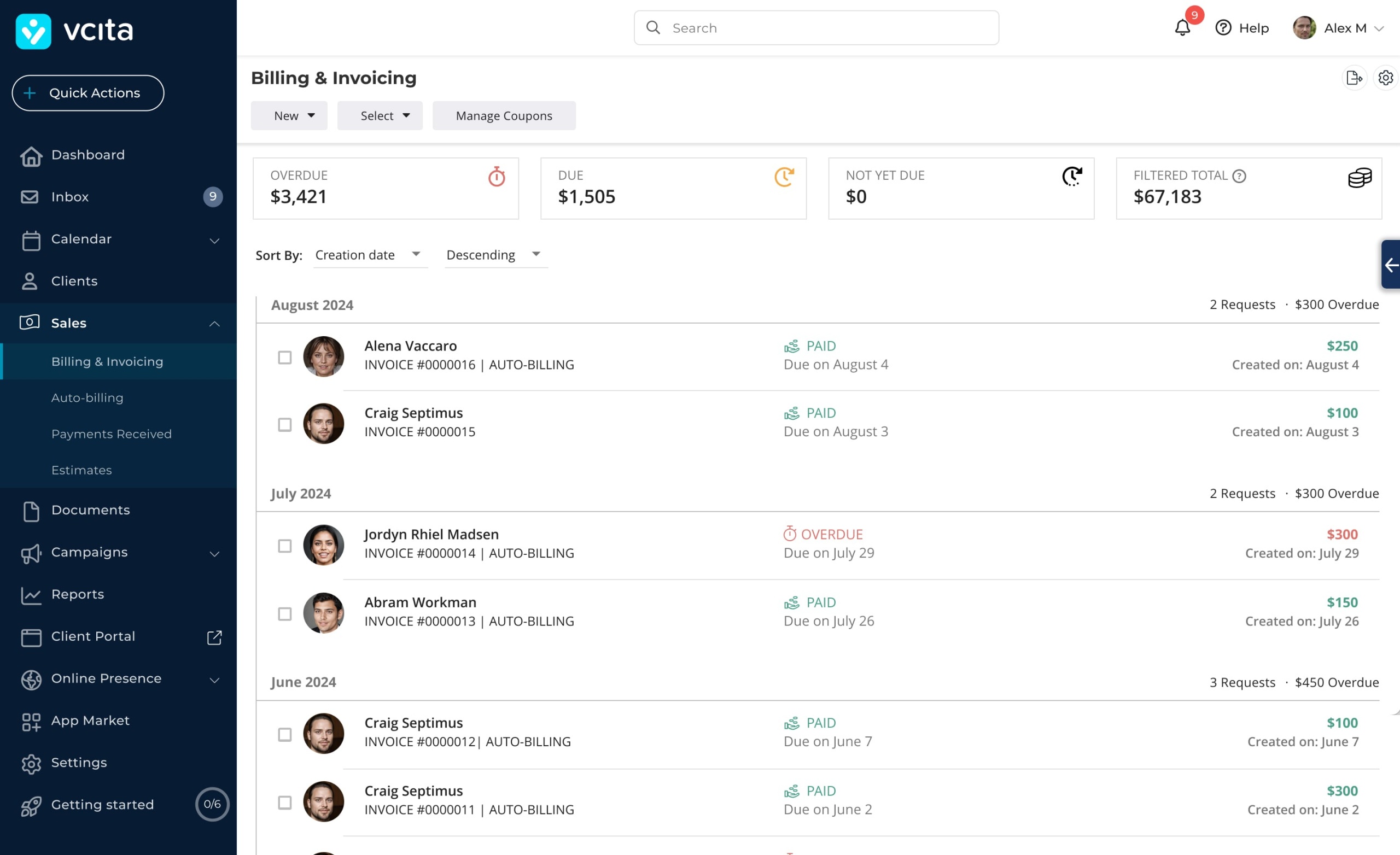

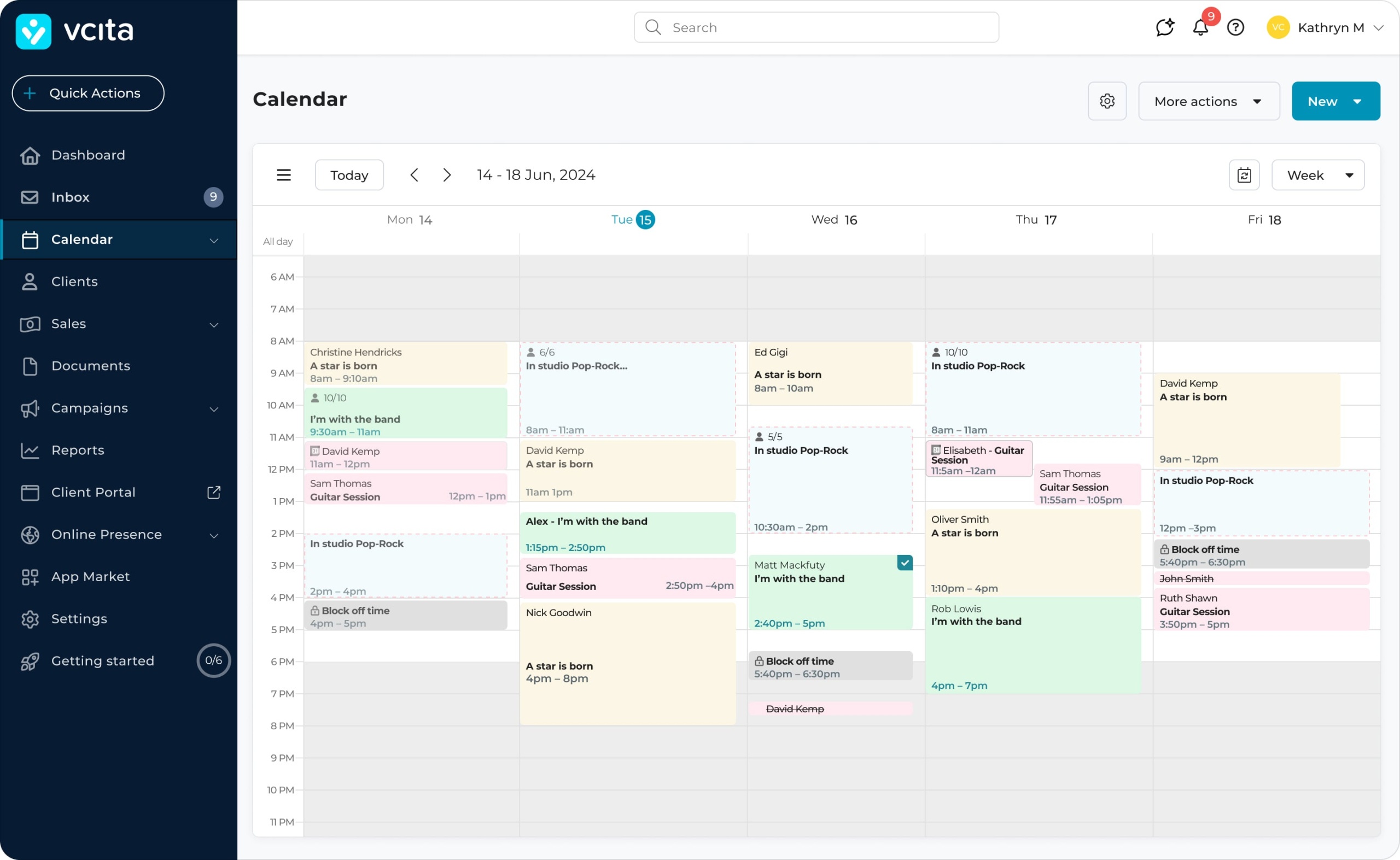

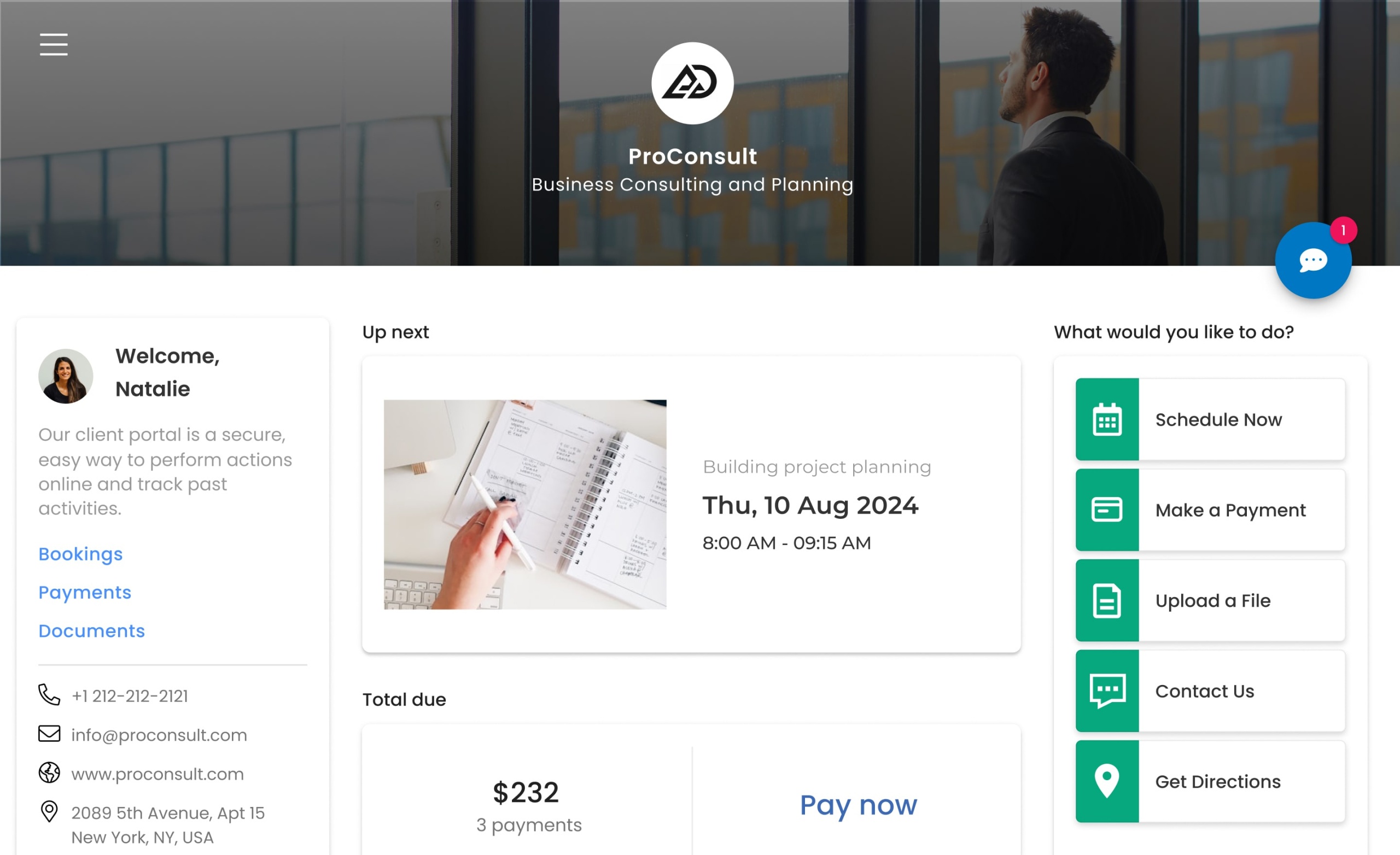

ONLINE PAYMENT PROCESSING

Easy payment collection for

busy businesses

Accept payments with vcita’s user-friendly online payment processing for small businesses. Make your payment collection smooth and hassle-free with our secure payment collection options.

No credit card required